AML Compliance under IFSCA (AML, CFT & KYC) Guidelines

AML India

AML India announces the launch of tailored AML offerings for IFSC entities that are subject to compliance with IFSCA (AML, CFT, and KYC) Guidelines, 2022.

— Jyoti Maheshwari – Partner

AHMEDABAD, GUJARAT, INDIA, October 30, 2023 /EINPresswire.com/ — AML India is excited to announce that we have amplified our services, bringing forward tailored AML offerings for IFSC entities registered under the International Financial Services Centres Authority and subject to compliance with IFSCA (AML, CFT, and KYC) Guidelines, 2022.

AML India is an anti-money laundering consulting firm in India dedicated to assisting reporting entities to adhere to AML compliance obligations and safeguard their business from potential vulnerabilities to financial crime. So far, the services have only revolved around the Prevention of Money Laundering Act, 2002 (PMLA) and rules issued thereunder. Now, this expands to cover the IFSCA (AML, CFT & KYC) Guidelines, 2022, to provide focused end-to-end AML consultancy services to IFSC units.

AML India, with its subject expertise and regulatory knowledge, is all set to guide IFSC entities with comprehensive AML consulting support, including but not limited to assessing the money laundering risk to the business considering the international nature of their operations, creating a comprehensive AML policy documentation tailored to your IFSC entity, providing in-depth AML training to employees to ensure effective implementation of the AML program, and assistance in identifying and implementing the AML software.

Pathik Shah, AML India’s Founder, said, “We are continuously supporting regulated entities across India as well as globally in complying with anti-money laundering regulations. Now, we have boosted our AML consultancy services and developed exclusive AML compliance services to cater to IFSC entities. With our experience dealing with businesses from different geographies and domains, IFSC entities will need to look no further for AML compliance support and services.”

Further, AML India’s Partner, Jyoti Maheshwari, added, “With the best practices, tools, and resources, we strive daily to stay as a barrier between regulated entities and money launderers. Our AML consultants wish to serve IFSC entities with the same dedication and ensure that no business misses any AML compliance required or stands a chance of getting abused for routing illegal funds. This also allows entities to keep up their reputation and avoid hefty non-compliance penalties that can become hurdles to a business’s growth.”

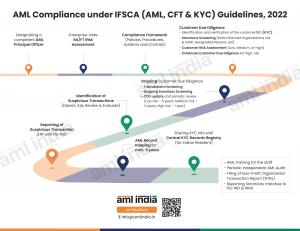

About AML India’s IFSC-Focused AML Consultancy Services

AML India’s IFSC-dedicated team shall address the AML concerns of the entities operating in or from IFSC and help them comply with the requirements of the IFSCA (AML/CFT and KYC) Guidelines, 2022. We shall be committed to understanding the business’s risk and customize the AML function to boost AML compliance and strengthen the shield against money laundering and terrorism financing.

Our array of AML consultancy services for IFSC entities includes:

– Enterprise-Wide Risk Assessment, aiming to develop the business’s ML/FT risk profile

– Documentation of AML Policies and Procedures, personalized to the tune of the risk assessed and IFSCA (AML, CFT, and KYC) Guidelines, 2022

– Assistance in setting up an In-house AML Compliance Department, making sure that the right resources are in place to manage the AML function

– Imparting comprehensive AML Training, empowering the AML Principal Officer and the compliance team to implement the AML program successfully

– Assistance in identifying and deploying the right AML Software that completes the AML program

– Conducting AML Health Check to test the existing AML compliance efforts, identify gaps and provide recommendations to resolve these gaps.

Pathik Shah

NIYEAHMA Consultants LLP

+91 98248 84900

email us here

Visit us on social media:

Facebook

LinkedIn

YouTube

Other

Appointment and Role of Principal Officer in IFSCA regulated entity

![]()