Also on this letter:

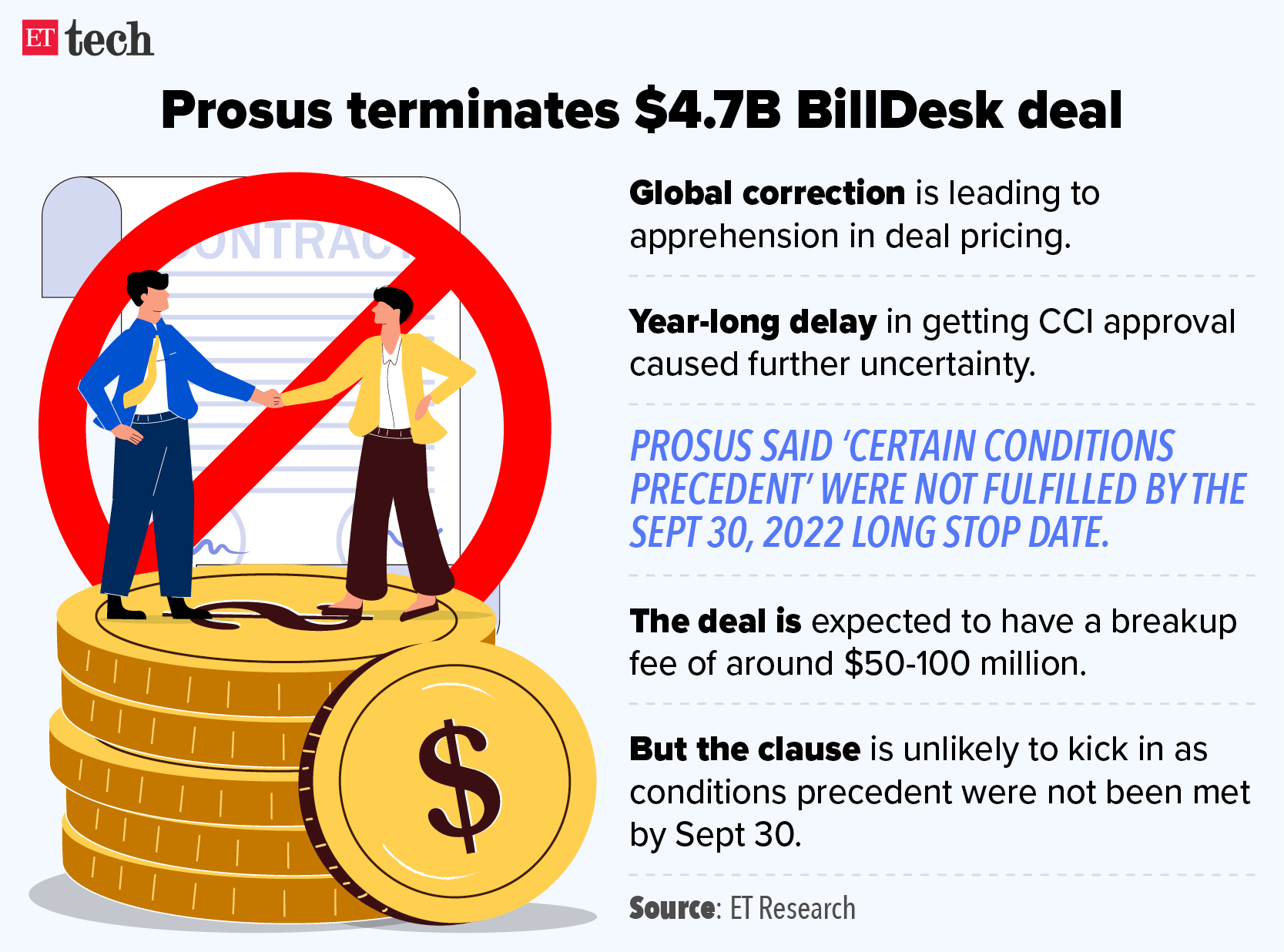

■ PayU-BillDesk deal included $50-100 million breakup free

■ Govt to spend as much as $1.3 billion to improve Mohali semiconductor lab

■ Crypto trade WazirX sacks 50-70 staff

Prosus, the funding arm of South African multinational Naspers, mentioned on Monday it has terminated its $4.7 billion acquisition of on-line funds gateway agency BillDesk by its Indian subsidiary PayU Payments.

This brings to an in depth what would have been the second largest buyout of an Indian digital know-how startup after Walmart’s $16 billion buy of a majority stake in on-line retailer Flipkart in 2018.

Catch up fast: On August 31, 2021, Prosus introduced it will purchase BillDesk for $4.7 billion in an all-cash deal to broaden its footprint within the nation’s booming fintech sector via its cost gateway PayU.

The merger was anticipated to create a web based funds gateway juggernaut that may course of $147 billion in annualised whole funds worth (TPV), almost twice that of its nearest contender Razorpay, which processes $80 billion in annual TPV.

Why did Prosus again out? The “abrupt move”, introduced on Monday, was triggered largely by the continuing correction in international markets, which rendered the year-old transaction “over-priced”, sources advised us.

Eoin Ryan, head of investor relations at Prosus mentioned “certain conditions precedent were not fulfilled by the September 30, 2022 long stop date, causing the agreement to be terminated automatically,’ in a note published on the company’s website. He did not elaborate on what these conditions were.

CCI nod: The Dutch-listed firm’s decision to pull out comes barely a month after India’s antitrust regulator – Competition Commission of India — approved the contours of the deal that was first announced in September 2021.

Fintech in turmoil: Top industry executives tracking the progress of the deal said the steep fall in the valuation of major US payments firms in recent months put the pricing of the BillDesk-PayU deal under severe pressure.

Prosus’s deal to acquire BillDesk for $4.7 billion included a breakup fee of around $50-100 million, sources told us.

Yes, but: This clause is unlikely to kick in as Prosus terminated the deal citing a condition precedent (CP) that had not been met by September 30, the long stop date, they said.

A breakup fee is a predetermined penalty that a buyer typically pays if it walks away from a transaction. A long stop date is the date by which the deal conditions must be satisfied (or waived) for it to be completed.

Timing: Sources said Prosus seems to have waited until September 30 to ensure it would not be liable to pay the penalty.

Talks on renegotiating the deal size down to $3 billion had not been successful as BillDesk was not in favour of it, said a third person.

Common practice: Breakup fees are common in large mergers and acquisitions. Recently, when Tesla cofounder Elon Musk reneged on buying microblogging platform Twitter for $44 billion, it was reported that he would have to pay a $1 billion breakup fee. It would have been the same if Twitter had cancelled the transaction.

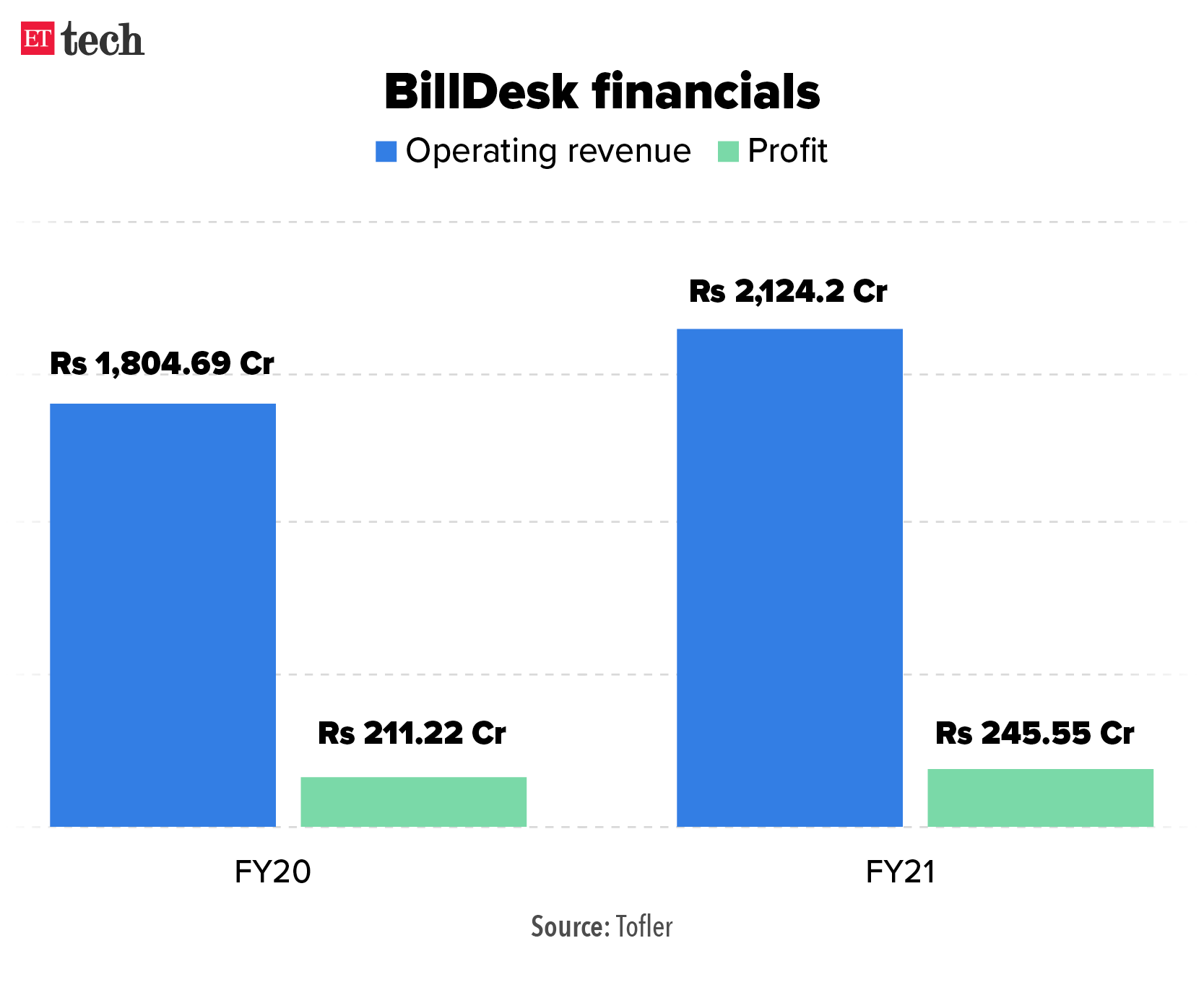

Financials: According to regulatory filings sourced by Tofler, BillDesk recorded a consolidated operational revenue of Rs 2,124 crore in FY21 compared to Rs 1,804.69 crore in the previous year. During the same period, it made a profit of Rs 245.55 crore against Rs 211.22 crore in the year before.

Also Read: As Prosus drops BillDesk deal, here are the biggest failed ‘tech-overs’ ever

The government plans to spend $1.25-1.30 billion to modernise and upgrade its semiconductor laboratory SCL in Mohali, sources told us.

The capital expenditure, by the Ministry of Electronics and IT, will come from the government’s $10 billion semiconductor incentive package and is intended to strengthen India’s intellectual property rights (IPR) in the semiconductor space, the sources added.

SCL, which was until six months ago under the Indian Space Research Organisation (Isro), has been placed under the ambit of the IT ministry. SCL has floated a request for proposal (RFP) inviting bids for the modernisation plan. We have reviewed a copy of the RFP.

As per the terms of the RFP, bidders also need to onboard a commercial partner for the fabrication of chips developed by the SCL. The last date for submission of bids is October 25.

SCL is the only government-owned semiconductor fabrication unit that produces chips for strategic purposes.

Cryptocurrency exchange WazirX fired about 50-70 employees on September 30 amid declining business, people familiar with the matter said.

Employees from business development, policy, growth, and marketing were affected, they added.

Decimated: During the crypto bull run of 2021, WazirX was India’s largest exchange by volume, clocking trades of $43 billion in the calendar year.

But the trading volumes fell by up to 90%, we reported on April 12, after a new tax regime kicked in on April 1.

Layoffs by crypto companies have loomed large amid a market crash and falling prices of cryptocurrencies. Indian employees of other crypto exchanges including Coinbase and Vauld have also been laid off in recent months.

Quote: “If someone like WazirX can do this, then anything can happen in the crypto industry and smaller players in India,” a former worker mentioned. “We need to put our minds to it and decide if we want to stay in the crypto industry or not,” the 32-year-old worker, who was laid off after two years with the corporate, added.

Fintech platform PhonePe introduced on Monday it has accomplished the method of shifting its domicile from Singapore to India.

The entire shebang: The firm mentioned in a press release it has moved all companies and subsidiaries of PhonePe Singapore to PhonePe Pvt Ltd – India immediately, together with its insurance broking providers and wealth broking companies.

Twists and turns: PhonePe, based by former Flipkart executives Sameer Nigam, Rahul Chari and Burzin Engineer, was purchased by the ecommerce firm in 2016. Two years later it grew to become part of Walmart after the US retail large acquired Flipkart.

PhonePe had in 2019 acquired in-principle approval from Flipkart’s board to be hived off as a separate entity. In June 2022, ET reported that the separation course of was underway and executives at PhonePe had been seeking to formally shut it in one other month or two.

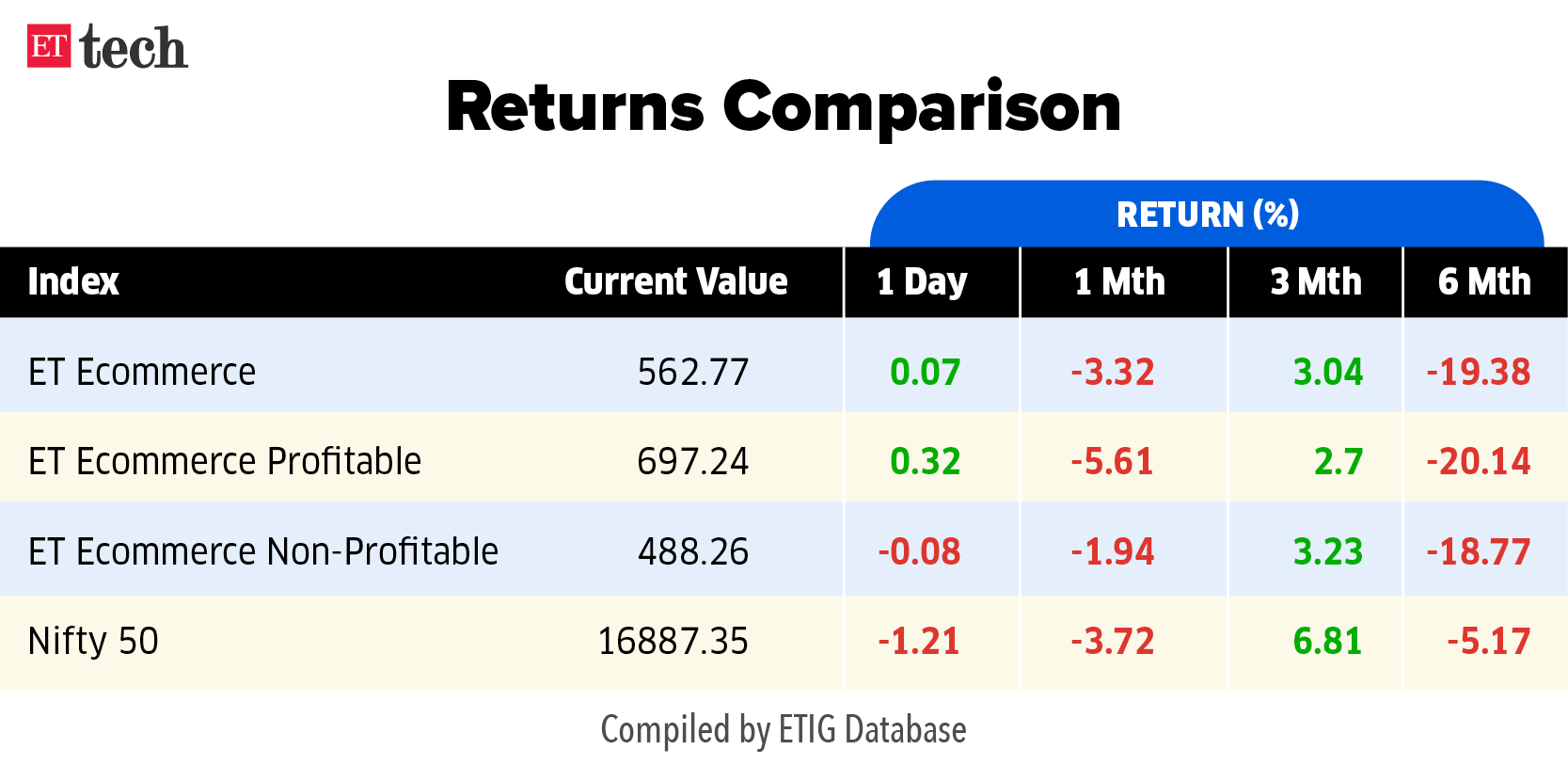

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to trace the efficiency of just lately listed tech companies. Here’s how they’ve fared thus far.

Other Top Stories By Our Reporters

Nykaa board approves 5:1 bonus shares subject: Shares of FSN E-Commerce, the mum or dad firm of Nykaa, rallied 11% to an intra-day excessive of Rs 1,414 on Monday after the corporate introduced a 5:1 bonus share subject. The inventory closed the day at Rs 1,304.20, up round 2.5%.

Lack of cloud coverage, expertise might decelerate adoption of cloud-driven options, says AWS exec: The lack of a cloud coverage framework and expertise might decelerate the adoption of cloud-driven options regardless of demand remaining excessive following the Covid-19 pandemic, a senior Amazon Web Services govt mentioned. Lack of expertise, particularly, stays a key problem for the trade, Max Peterson, vp, worldwide public sector, AWS advised ET.

Global Picks We Are Reading

■ Brazil adopted digital voting years in the past. Some say they nonetheless don’t belief it (Rest of World)

■ The excessive value of residing your life on-line (Wired)

■ Tesla deliveries bounce again to document, although dented by distribution delays (WSJ)