Dan Burghardt, Renowned Insurance Expert, Highlights the Potential Pitfalls of Term Life Insurance

— Dan Burghardt

NEW ORLEANS, LOUISIANA, UNITED STATES, May 15, 2023/EINPresswire.com/ — Term life insurance, while popular, may not be the best fit for everyone. As part of an ongoing commitment to consumer education, industry expert Dan Burghardt, president and CEO of Dan Burghardt Insurance, highlights key potential pitfalls of term life insurance.

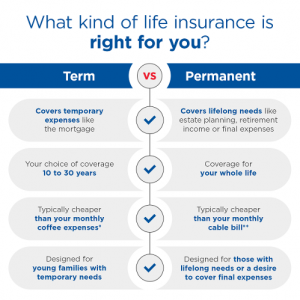

Term life insurance is often seen as an attractive option due to its affordability and simplicity, but it’s not without potential downsides. One of the primary disadvantages is the temporary nature of coverage. Term life insurance policies only cover a specific time period – typically 10 to 30 years. If the policyholder outlives this term, their coverage ends, potentially leaving them unprotected.

“Many people don’t realize that term life insurance is just that – term. It’s not designed to last a lifetime,” Burghardt explains. “If you outlive your policy and then find you need coverage, you’ll be older and possibly not in the same health. This could make securing a new policy significantly more expensive or even impossible. When purchasing term insurance make sure it has a Guaranteed Renewal and Convertible Riders so you are not required to be medically underwritten to extend or convert the term policy when it expires”

Another concern with term life insurance is the lack of cash value. Unlike permanent life insurance policies, term life does not accumulate any cash value that can be borrowed against or cashed in.

“Term life is essentially ‘renting’ your coverage,” says Burghardt. “You pay your premiums, and if you pass away within the term, your beneficiaries receive the death benefit. But if you outlive the term, there’s no return on your investment. You’ve paid in, but you get nothing back.”

While term life insurance can be an effective part of a larger financial plan, consumers should be aware of its limitations. Understanding these potential pitfalls can help individuals make more informed decisions about their life insurance needs.

Burghardt encourages those considering term life insurance to seek advice from a knowledgeable insurance professional. He also stresses the importance of considering one’s long-term needs and financial goals before making a decision.

“Term life insurance is not a bad product, but it’s crucial to understand what you’re buying,” Burghardt concludes. “Ask questions, understand your needs, and make sure the policy you choose truly fits those needs.”

Adding to the points already discussed, it’s essential to remember that term life insurance does not have the flexibility to adapt to changing circumstances. Unlike certain permanent policies, term life insurance does not offer options to adjust coverage or premiums over time.

Burghardt emphasizes, “Life is unpredictable, and our insurance needs change as we move through different life stages. With term life, you are locked into a fixed coverage amount for the entire term. If your situation changes significantly, you may find yourself underinsured or overinsured.”

Furthermore, it’s crucial to consider the emotional aspect of term life insurance. The pressure of a ticking clock could lead to undue stress for policyholders as they approach the end of their term.

“The end of a term life policy can provoke a lot of anxiety,” Burghardt says. “People start worrying about what will happen if they pass away the day after their policy ends. That’s a lot of stress to carry around, and it’s something to consider when choosing your coverage.”

Ultimately, the decision to purchase term life insurance should not be taken lightly. It requires careful consideration and understanding of the potential downsides. By understanding these issues, consumers can make the best possible decision for their specific situation.

Burghardt concludes, “Life insurance is an essential part of financial planning, but it should never be a one-size-fits-all solution. Tailoring coverage to individual needs and circumstances is key. And remember, it’s not just about protecting your life, but also about ensuring peace of mind.”

Morgan Thomas

Rhino Digital, LLC

+1 504-875-5036

email us here

Visit us on social media:

Facebook

![]()