Country’s largest lender State Bank of India reported a ~75% y-o-y earnings enhance, led by working earnings doubling yr on yr. Loan progress was strong at 20% y-o-y, internet curiosity margin expanded ~30bps q-o-q, negligible slippages, gross non-performing loans (NPL) declined 40bps q-o-q and internet NPLs fell 20bps q-o-q. Return on fairness (RoE) touched ~18%. Valuations are nonetheless not costly, regardless of this sturdy outperformance. We keep a ranking of BUY.

SBI reported ~75% y-o-y earnings progress, led by working earnings doubling y-o-y. Revenues grew 12% y-o-y with NII progress at 13% y-o-y, whereas non-interest earnings (NII) grew 8% y-o-y. NIM expanded 30bps q-o-q to three.3%. Loans grew 20% y-o-y, which is at a decade excessive. Asset quality metrics confirmed additional enchancment, with the gross NPL ratio declining 40bps q-o-q to three.5% and internet NPL ratio declining 20bps q-o-q to 0.8%. Provision protection ratio (PCR) stood at 78%. RoE stood at 18% and RoA at 1% of loans.

Our conversations with buyers are shifting to peak earnings and return ratios from asset quality. There is robust consolation on SBI’s asset quality. The key query is what’s the peak a number of for the financial institution and return ratios to justify that a number of. Peaks and troughs of cycles are laborious to foretell, and regulatory interventions similar to these seen just lately internationally make it much more difficult.

Also learn: Nippon Life has no plans to exit Reliance Nippon Life

We have a look at the scenario at the moment as: (i) asset quality is snug, (ii) near-term credit score value is more likely to be lower-than-long-term common, (iii) no asset bubbles, particularly in actual property, at present, and (iv) capex-led loans, which are likely to have a better default than SME/retail loans, should not dominating mortgage progress.

Keeping a optimistic thesis is probably the very best funding thesis on SBI, regardless of the sharp outperformance lately. The construction of the mortgage guide means that the slowdown, if any, seems to be progress slowdown fairly than a credit score value downside at present. There is a excessive likelihood that the decrease credit score prices can offset the strain that might emerge from NIM compression, slower price earnings progress or a slightly larger value construction.

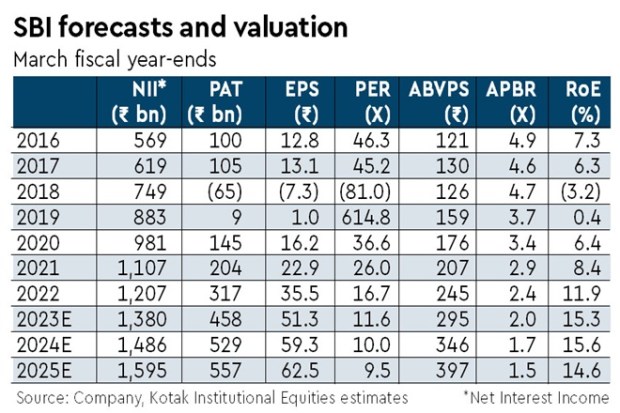

We keep BUY with a FV of `725, at a valuation of 1.4X (adj.) guide and 9X September 2024 EPS for RoEs of ~15%. There is a robust re-rating of the financial institution in current quarters. Earnings upgrades, led by decrease credit score prices, have given consolation to this re-rating. However, we’re getting nearer to peak RoEs and re-rating is more likely to get so much slower.

Given the benign asset quality surroundings at the moment, we anticipate SBI to proceed displaying healthy asset quality efficiency. Slippages are more likely to keep contained, with sturdy recoveries and upgradations. The general restructured guide is comparatively restricted for the financial institution. Hence, we anticipate the credit score value to be beneath the historic common within the close to time period.

Also learn: Aditya Birla Capital will get nod to bid for Reliance Nippon Life Insurance

Of the financial institution’s mortgage guide, ~41% is linked to marginal value of funds primarily based touchdown price (MCLR), 34% is linked to exterior benchmark primarily based lending price (EBLR), 21% is fastened price and the remaining is linked to different exterior benchmarks. There is room for additional enchancment in yields, as the complete influence of exterior benchmark-based pricing takes form and all the MCLR-linked portfolio will get repriced. As a consequence, we anticipate SBI’s margins to develop no less than for one more quarter, after which the rise in value of funds will begin offsetting the achieve on yields entrance.