[Under Section 45ZL of the Reserve Bank of India Act, 1934]

The thirty eighth assembly of the Monetary Policy Committee (MPC), constituted underneath part 45ZB of the Reserve Bank of India Act, 1934, was held throughout September 28-30, 2022.

2. The assembly was attended by all of the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board underneath Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in cost of financial coverage – and was chaired by Shri Shaktikanta Das, Governor.

3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after each assembly of the Monetary Policy Committee, the minutes of the proceedings of the assembly which shall embrace the next, particularly:

-

the decision adopted on the assembly of the Monetary Policy Committee;

-

the vote of every member of the Monetary Policy Committee, ascribed to such member, on the decision adopted within the stated assembly; and

-

the assertion of every member of the Monetary Policy Committee underneath sub-part (11) of part 45ZI on the decision adopted within the stated assembly.

4. The MPC reviewed the surveys carried out by the Reserve Bank to gauge client confidence, households’ inflation expectations, company sector efficiency, credit score circumstances, the outlook for the economic, providers and infrastructure sectors, and the projections of skilled forecasters. The MPC additionally reviewed intimately the workers’s macroeconomic projections, and different eventualities round numerous dangers to the outlook. Drawing on the above and after in depth discussions on the stance of financial coverage, the MPC adopted the decision that’s set out under.

Resolution

5. On the idea of an evaluation of the present and evolving macroeconomic scenario, the Monetary Policy Committee (MPC) at its assembly right now (September 30, 2022) determined to:

- Increase the coverage repo price underneath the liquidity adjustment facility (LAF) by 50 foundation factors to five.90 per cent with instant impact.

Consequently, the standing deposit facility (SDF) price stands adjusted to five.65 per cent and the marginal standing facility (MSF) price and the Bank Rate to six.15 per cent.

- The MPC additionally determined to stay centered on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress.

These choices are in consonance with the target of reaching the medium-time period goal for client worth index (CPI) inflation of 4 per cent inside a band of +/- 2 per cent, whereas supporting progress.

The major issues underlying the choice are set out within the assertion under.

Assessment

Global Economy

6. Global financial exercise is weakening underneath the influence of the protracted battle in Ukraine and aggressive financial coverage actions and stances internationally. As monetary circumstances tighten, international monetary markets are experiencing surges of volatility, with sporadic promote-offs in fairness and bond markets, and the US greenback strengthening to a 20-yr excessive. Emerging market economies (EMEs) are going through intensified pressures from retrenchment of portfolio flows, foreign money depreciations, reserve losses and monetary stability dangers, apart from the worldwide inflation shock. As exterior demand deteriorates, their macroeconomic outlook is changing into more and more hostile.

Domestic Economy

7. Real gross home product (GDP) grew yr-on-yr (y-o-y) by 13.5 per cent in Q1:2022-23. While all constituents of home combination demand expanded y-o-y and exceeded their pre-pandemic ranges, the drag from web exports supplied an offset. On the provision aspect, gross worth added (GVA) rose by 12.7 per cent in Q1:2022-23, with all constituents recording y-o-y progress and most notably, providers.

8. Aggregate provide circumstances are enhancing. With the south-west monsoon rainfall 7 per cent above the lengthy interval common (LPA) as on September 29 and its spatial distribution spreading to some deficit areas, kharif sowing has been catching up. Acreage was 1.7 per cent above the traditional sown space as on September 23 and only one.2 per cent under final yr’s protection. The manufacturing of kharif foodgrains as per first advance estimates (FAE) was 3.9 per cent under final yr’s fourth advance estimates (solely 0.4 per cent under final yr’s FAE). Activity in trade and providers sectors stays in enlargement, particularly the latter, as mirrored in buying managers indices (PMIs) and different excessive frequency indicators. The index of industrial manufacturing progress, nevertheless, slowed to 2.4 per cent (y-o-y) in July.

9. On the demand aspect, city consumption is being lifted by discretionary spending forward of the pageant season and rural demand is steadily enhancing. Investment demand can be gaining traction, as mirrored in rising imports and home manufacturing of capital items, metal consumption and cement manufacturing. Merchandise exports posted a modest enlargement in August. Non-oil non-gold imports remained buoyant.

10. CPI inflation rose to 7.0 per cent (y-o-y) in August 2022 from 6.7 per cent in July as meals inflation moved larger, pushed by costs of cereals, greens, pulses, spices and milk. Fuel inflation moderated with discount in kerosene (PDS) costs, although it remained in double digits. Core CPI (i.e., CPI excluding meals and gasoline) inflation remained sticky at heightened ranges, with upside pressures throughout numerous constituent items and providers.

11. Overall system liquidity remained in surplus, with the typical day by day absorption underneath the liquidity adjustment facility (LAF) easing to ₹2.3 lakh crore throughout August-September (as much as September 28, 2022) from ₹3.8 lakh crore in June-July. Money provide (M3) expanded y-o-y by 8.9 per cent, with combination deposits of business banks rising by 9.5 per cent and financial institution credit score by 16.2 per cent as on September 9, 2022. India’s overseas alternate reserves had been positioned at US$ 537.5 billion as on September 23, 2022.

Outlook

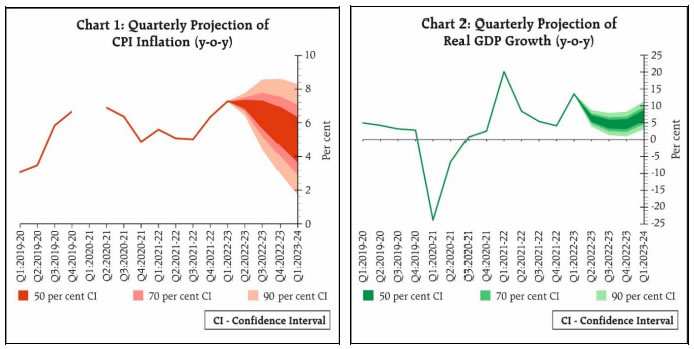

12. High and protracted uncertainty surrounding the course of geopolitical circumstances weighs closely on the inflation outlook. Commodity costs, nevertheless, have softened and recession dangers in superior economies (AEs) are rising. On the home entrance, the late restoration in sowing augurs properly for kharif output. The prospects for the rabi crop are buffered by comfy reservoir ranges. The danger of crop harm from extreme/unseasonal rains, nevertheless, stays. These elements have implications for the meals worth outlook. Elevated imported inflation pressures stay an upside danger for the longer term trajectory of inflation, amplified by the persevering with appreciation of the US greenback. The outlook for crude oil costs is extremely unsure and tethered to geopolitical developments, with attendant considerations referring to each provide and demand. The Reserve Bank’s enterprise surveys level to some easing of enter price and output worth pressures throughout manufacturing, providers and infrastructure companies; nevertheless, the move-by means of of enter prices to costs stays incomplete. Taking under consideration these elements and a mean crude oil worth (Indian basket) of US$ 100 per barrel, inflation is projected at 6.7 per cent in 2022-23, with Q2 at 7.1 per cent; Q3 at 6.5 per cent; and This fall at 5.8 per cent, and dangers are evenly balanced. CPI inflation for Q1:2023-24 is projected at 5.0 per cent (Chart 1).

13. On progress, the enhancing outlook for agriculture and allied actions and rebound in providers are boosting the prospects for combination provide. The Government’s continued thrust on capex, enchancment in capability utilisation in manufacturing and decide-up in non-meals credit score ought to maintain the enlargement in industrial exercise that stalled in July. The outlook for combination demand is constructive, with rural demand catching up and concrete demand anticipated to strengthen additional with the standard upturn within the second half of the yr. According to the RBI’s surveys, client outlook stays secure and companies in manufacturing, providers and infrastructure sectors are optimistic about demand circumstances and gross sales prospects. On the opposite hand, headwinds from geopolitical tensions, tightening international monetary circumstances and the slowing exterior demand pose draw back dangers to web exports and therefore to India’s GDP outlook. Taking all these elements into consideration, actual GDP progress for 2022-23 is projected at 7.0 per cent with Q2 at 6.3 per cent; Q3 at 4.6 per cent; and This fall at 4.6 per cent, and dangers broadly balanced. For Q1:2023-24, it’s projected at 7.2 per cent (Chart 2).

14. In the MPC’s view, inflation is more likely to be above the higher tolerance stage of 6 per cent by means of the primary three quarters of 2022-23, with core inflation remaining excessive. The outlook is fraught with appreciable uncertainty, given the unstable geopolitical scenario, international monetary market volatility and provide disruptions. Meanwhile, home financial exercise is holding up properly and is anticipated to be buoyant in H2:2022-23, supported by festive season demand amidst client and business optimism. The MPC is of the view that additional calibrated financial coverage motion is warranted to maintain inflation expectations anchored, restrain the broadening of worth pressures and pre-empt second spherical results. The MPC feels that this motion will assist medium-time period progress prospects. Accordingly, the MPC determined to extend the coverage repo price by 50 foundation factors to five.90 per cent. The MPC additionally determined to stay centered on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress.

15. Dr. Shashanka Bhide, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to extend the coverage repo price by 50 foundation factors. Dr. Ashima Goyal voted to extend the repo price by 35 foundation factors.

16. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to stay centered on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress. Prof. Jayanth R. Varma voted in opposition to this half of the decision.

17. The minutes of the MPC’s assembly shall be printed on October 14, 2022.

18. The subsequent assembly of the MPC is scheduled throughout December 5-7, 2022.

Voting on the Resolution to extend the coverage repo price to five.90 per cent

| Member | Vote |

| Dr. Shashanka Bhide | Yes |

| Dr. Ashima Goyal | No |

| Prof. Jayanth R. Varma | Yes |

| Dr. Rajiv Ranjan | Yes |

| Dr. Michael Debabrata Patra | Yes |

| Shri Shaktikanta Das | Yes |

Statement by Dr. Shashanka Bhide

19. The international macroeconomic circumstances have turn out to be hostile for progress and stability, significantly for the EMEs. While there are clear indicators of slowing progress momentum within the economies internationally, inflation continues at a lot larger charges than the goal for a lot of international locations. The uncertainty as a result of Russia-Ukraine struggle has continued impacting the vitality provides and costs. While the COVID-19 pandemic has weakened, sporadic surges in some main international locations are elevating concern. Global financial coverage tightening to include inflation pressures has elevated the potential for vital international progress deceleration and volatility in monetary markets. Declining export alternatives whereas imports remaining comparatively excessive have added to the hostile exterior atmosphere for the vitality importing EMEs.

20. The CPI inflation in India, yr-on-yr foundation, after a run of 7 per cent or extra between March and June 2022, dropped to six.7 per cent in July solely to rise to 7 per cent once more in August. With the exception of just a few product teams, the excessive price of worth rise was widespread. Food & Beverages and gasoline & gentle sub-teams of the CPI registered YOY charges above 7 per cent all through this era from March to August, with the exception of a price of 6.7 per cent within the case of meals & drinks in July. Only within the case of housing and pan, tobacco and intoxicants, among the many main classes of CPI, with a mixed weight of 12.45 per cent within the CPI, the inflation price was under 4 per cent in the course of the interval, with the exception of housing worth index which rose by 4.1 per cent in August. Among the opposite remaining sub-classes, clothes and footwear registered inflation price of about 9 per cent and the opposite remaining consumption objects constituting ‘miscellaneous’ sub-class registered inflation price of above 7 per cent in March and April adopted by decrease charges of 5-7 per cent within the subsequent May-August interval. However, there was a decline within the month over month momentum of the general CPI in May 2022 and it remained regular throughout June-August.

21. The coverage response internationally has been to tighten financial coverage. This coverage stance is anticipated to proceed to realize inflation targets.

22. Persistence of the upper price of worth improve at commodity and sectoral ranges within the home market is on account of each the direct or spill-over results of larger worldwide market costs and likewise the home elements. Any decline in costs on the client stage seems to be restrained by elevated ranges of enter costs though RBI’s enterprise surveys point out that the enter worth strain is anticipated to ease within the second half of the present monetary yr.

23. The RBI survey of households carried out in September 2022 on worth expectations signifies expectations of continued excessive price of inflation, with the typical anticipated inflation price being larger than within the survey carried out in July 2022. Inflation price can be anticipated to be larger 3-months forward and one-yr forward in comparison with the prevailing scenario. The expectations of future worth readings look like affected extra by the current circumstances than the doubtless influence of the decline within the commodity costs within the worldwide markets.

24. The survey of enterprises (Industrial Outlook Survey) carried out by RBI in September 2022 displays some reduction on promoting costs in H2:FY2022-23 because the proportion of respondents who anticipate promoting costs to rise drops in comparison with Q2: FY 2022-23. Although financing prices are anticipated to extend, different enter price pressures are anticipated to say no. The Wholesale Price Index, reflecting the worth circumstances on the producer stage, has registered double digit price of improve YOY foundation in July and August. While there’s a variation within the worth adjustments throughout the broad vary of commodities, in just a few main classes of commodities, the worth rise is critical. In the case of greens, fruits, crude petroleum, petrol, diesel, LPG and electrical energy, the WPI elevated at double digit charges in July and August. In the case of cereals, the rise was 9.8 per cent in July and 11.8 per cent in August. The influence of decline in worldwide market costs on home costs is but to move by means of to the home client costs.

25. The rainfall within the monsoon interval of June-September has exceeded the Long Period Average by the final week of September though the rainfall has been poor in elements of the japanese and north-japanese areas for a lot of the monsoon interval. The monsoon rains within the combination have improved the rabi crop prospects. Food commodity costs within the consumption basket shall be topic to the dimensions of the kharif harvest within the brief run.

26. In the context of continued excessive inflation price, the financial coverage price has elevated between May and August 2022. While the influence of this improve is starting to have an effect on the lending and deposit charges of the banking sector, its major influence on inflation can be by means of expectations of a decline in future inflation price and on the combination demand. There are of course different elements such because the slowing down of the worldwide economy and its influence on exports and combination demand. At this juncture, the hostile influence on combination demand could also be insulated by the seasonal elements such because the pageant season demand and the kharif crop harvest.

27. The Q1: FY2022-23 estimates of nationwide earnings by the NSO place fixed costs GDP progress at 13.5 per cent over the identical interval within the earlier yr. This is decrease than the RBI’s projection of 16.2 per cent supplied within the August assembly of the MPC. Despite the decrease than the projected progress, it displays sustained enchancment in progress over the pre-pandemic output stage of 2019-20 that started in Q2:FY2021-22. Both Private Final Consumption Expenditure and Gross Fixed Capital Formation, two main parts of combination demand, registered sharp improve in Q1:FY2022-23 YOY foundation. In this sense, the general progress momentum seems to have been sustained in Q1.

28. Given the decrease estimates of GDP progress for Q1, there may be uncertainty over sustaining the expansion momentum wanted to realize progress of 7.2 per cent for the complete yr, projected within the August MPC assembly. There are additionally indicators of weak point in demand circumstances within the qualitative outcomes of the RBI surveys of Enterprises (Industrial Outlook). The general Consumer Confidence Index as per the Consumer Confidence Survey (city households) exhibits optimism for one-yr forward expectations, albeit, prevailing circumstances are seen to be pessimistic. The improve in consumption expenditure over the earlier yr and one-yr forward expectation is extra broadly shared with respect to ‘essential expenditure’ as in comparison with ‘non-essential expenditure’. The expectations of general business outlook over the remaining quarters of FY 2022-23, primarily based on the Enterprise Surveys for September 2022 displays optimism but in addition divergence in sentiments in manufacturing, providers and infrastructure sectors. In this context, the revised GDP progress projection for FY 2022-23 is now at 7.0 per cent in comparison with 7.2 per cent in August. The quarterly progress charges for the yr are supplied within the Resolution.

29. In sum, there are vital uncertainties over the trajectories of progress and inflation. On the expansion entrance, the COVID-19 pandemic associated provide aspect constraints don’t look like vital. Improvement in non-public funding and consumption spending would require worth stability. The CPI inflation price has continued to be excessive – above/in extra of 6 per cent, from January 2022 onwards. While there are indications of decline within the momentum of worth rise, sustaining this decline in momentum is essential for reaching inflation and progress goals. To align the inflation expectations with the coverage goal price of inflation, additional improve in coverage charges is important at this juncture.

30. I vote to extend the coverage repo price by 50 foundation factors to five.9 per cent. I additionally vote to stay centered on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress.

Statement by Dr. Ashima Goyal

31. To begin with international elements, main superior economy central banks over-stimulated after Covid-19 and are over-reacting to inflation now, creating extra volatility in cross border flows to rising markets (EMs). Forward steering, whether or not hawkish or dovish, is dangerous in such unsure occasions. Being knowledge-primarily based permits actual sector adjustments to counter the impact of rates of interest on markets.

32. There are two mitigating elements for India, nevertheless. First, after an preliminary excessive response, cross border flows discriminate on a rustic foundation. As commodity costs soften with a world slowdown, some of the traders who had left India as a result of of its vulnerability to commodity inflation will return. Second, India nonetheless retains coverage house for smoothing international shocks. Domestic demand can counter falling export demand. It is vital for policymakers to remain calm to reasonable concern and over-response.

33. Turning to the home scenario, international commodity worth softening impacts WPI extra initially. CPI is rising as a result of of a cereal and finish monsoon meals worth spike. As a consequence family inflation expectations rose, whereas these of companies fluctuated round 5% in keeping with the IIM Ahmedabad survey. Rising uncertainty exhibits within the rising dispersion of family inflation expectations. But companies nonetheless see inflation at 5.5% by mid-2023.

34. While India has one of the best yr-on-yr progress charges on the earth there are some indicators of slowing down. Quarter on quarter GDP contracted in Q1. The OECD factors out that seasonally adjusted Indian quarter on quarter progress was the bottom after China and Poland. It is unsure if home demand will maintain after the pageant spike. RBI client surveys present 45% of households reported no improve in earnings ranges in comparison with a yr in the past.

35. Although the massive pandemic-time repo price minimize is reversed, we aren’t but on the terminal price. Demand discount has to contribute, together with different measures, to decreasing the present account deficit. A agency financial coverage response to inflation exceeding tolerance bands helps anchor expectations. The repo price has to rise extra. But ought to the rise be taken upfront or staggered over time? We look at the arguments for and in opposition to frontloading.

36. When behaviour is ahead-wanting entrance loading can pre-empt inflationary pressures. But if lagged results of financial coverage are massive, as in India, over-response might be very pricey. Harmful results turn out to be clear too late and are troublesome to reverse. Gradual knowledge-primarily based motion reduces the likelihood of over-response. Taking Indian repo charges too excessive imposed heavy prices in 2011, 2014 and 2018. A credit score and funding slowdown was aggravated and sustained. It is important to go very fastidiously now that ahead-wanting actual rates of interest are constructive.

37. The sacrifice of output from tightening is low if unemployment is low and there may be extra demand. Setting charges to cut back extra demand to zero has little output price and the necessity for future price hikes are lowered. In India, nevertheless, unemployment is excessive. That there isn’t any second spherical inflation from wage rise factors to slack labour markets. Employment is simply recovering from a sequence of international shocks and demand could also be slowing.

38. High uncertainty additionally requires sluggish steps. If demand slows anyway, much less coverage tightening shall be required. That each inflation and progress had been barely decrease than final quarter RBI projections could point out the impact of tightening was underestimated. It is important to observe the softening of commodity costs. If they hunch actual charges can shoot up too excessive as in 2014-15.

39. If inflation expectations are unanchored a big sacrifice could also be referred to as for to reverse them. But in EMs communication has extra influence. Continuing provide-aspect motion, international softening and clear communication about these elements all assist anchor inflation expectations. If the goal is headline inflation with a big commodity part for which fiscal motion has better influence there may be extra duty on the federal government to behave. The Indian authorities has demonstrated dedication to decreasing prices of dwelling and to enhancing infrastructure.

40. A BIS research1 of previous nation expertise together with 6 EMs discovered frontloaded actions are typically adopted by gentle landings however common 45% of the coverage price rise was frontloaded in gentle landings and the imply nominal price hike was 2%. Large hikes had been required in India to reverse steep pandemic-time cuts. Since that’s accomplished, going sluggish now will enable coverage to be agile and knowledge-primarily based. Extremes are at all times harmful; 100% entrance loading can simply overshoot. Moderation is best.

41. Households are inclined to have a stagflationary view, so that they anticipate inflation to rise when progress falls2. In addition, Indian households anticipate inflation to extend if the repo price will increase3. Excessive price rises won’t make inflation concentrating on credible if they’re unable to decrease provide-aspect inflation and as a substitute increase prices as demand and funding falls.

42. Most analysts are arguing for a 50 bps rise simply to protect a ramification with US coverage charges. This is a concern pushed over-response. In the mid-2000s the unfold was lower than 150 bps and there have been massive capital inflows. In the previous 2 years spreads of above 300 bps haven’t introduced in debt flows. If the terminal Fed price is 5%, will it require we increase ours to eight%? The carry commerce is just not a secure supply of financing. India has earned sufficient independence to guard itself from coverage errors of different nations.

43. In view of all these issues, and to sign tapering of motion, I vote for a 35 bps rise within the repo price. Both RBI and SPF headline forecasts for Q1 FY2023-24 are round 5%, implying the true price shall be roughly 0.75% with the repo price at 5.75%. This is sort of one, and may exceed unity if the autumn in inflation is bigger. This might be harmful if progress slows. The MPC has to concentrate on the 6 month to 1 yr forward actual price, as that is the horizon the place financial coverage could have its best influence.

44. Moreover, as banking liquidity is tightening, there shall be extra move by means of. Over time LAF instruments and forecasting of liquidity shocks ought to develop to the purpose the place a impartial MPC stance implies weighted common cash market charges are maintained within the center of the LAF hall. At current I vote to proceed with the ‘withdrawal of accommodation stance’ since sturdy liquidity continues to be in surplus. This, along with sufficient adjustment of brief-time period liquidity, is required to counter international quantitative tightening (QT) and potential outflows, as required. The very sluggish tempo of QT in comparison with the massive surplus created, together with selective CB interventions, could also be ample, if we’re fortunate, to forestall monetary instability regardless of the fast coordinated international rise in coverage charges.

Statement by Prof. Jayanth R. Varma

45. I wrote in my August assertion that additional withdrawal of lodging is warranted past the speed improve in that assembly. However, I additionally indicated that we could also be starting to method the terminal repo price. My view stays largely the identical right now, and primarily based on this, I believe the MPC ought to now increase the coverage price to six p.c after which take a pause.

46. A pause is required after this hike as a result of financial coverage acts with lags. It could take 3-4 quarters for the coverage price to be transmitted to the true economy, and the height impact could take so long as 5-6 quarters. If we increase the repo price to round 6 p.c at this assembly, that might be a cumulative improve of round two proportion factors within the house of simply 4 months. Even this understates the extent of financial tightening, as a result of, just a few months in the past, cash market charges had been near the reverse repo price (65 foundation factors under the repo price). Taking this under consideration, the complete magnitude of financial tightening can be properly over 250 foundation factors.

47. Much of the influence of this huge financial coverage motion is but to be felt in the true economy. In reality, a lot of the coverage price motion is but to be transmitted to even the broader spectrum of rates of interest. For instance, lower than a 3rd of the rise within the repo price throughout April-August has been transmitted to retail financial institution deposit charges. Bank deposit rates of interest play a vital function in stimulating financial savings, dampening consumption demand, and thereby mitigating inflationary pressures. We ought to hopefully see extra of this transmission in ensuing quarters. While there was a lot larger transmission from coverage charges to lending charges, the transmission from lending charges to the true economy would additionally take time.

48. All because of this it’s too early to know whether or not the coverage motion up to now is ample or not. It could properly prove that much more financial tightening is required, however it does make sense to attend and watch to see whether or not a repo price of round 6 p.c is ample to glide inflation again to focus on. If we had been to proceed to tighten and not using a actuality verify, we’d run the chance of overshooting the repo price wanted to realize worth stability. It is true that inflation is at present properly above 6 p.c. However, since financial coverage acts with lags, what’s related is the inflation forecasts 3-4 quarters forward. Both the RBI’s forecasts and the survey of skilled forecasters present inflation falling to round 5 p.c within the first quarter of the subsequent monetary yr. Relative to this forecast, a coverage price of round 6 p.c wouldn’t solely be a constructive actual price, but in addition doubtless above the impartial price.

49. In my view, it’s harmful to push the coverage price properly above the impartial price in an atmosphere the place the expansion outlook could be very fragile. While the extent of financial output has recovered to pre pandemic ranges, it stays properly under the pre pandemic development line. Tightening international monetary circumstances and recessionary fears in superior economies are appearing as drags on the home economy as properly. Weakening export progress implies that financial progress needs to be pushed by home demand which continues to be not sufficiently strong. Much of the hope for financial progress rests on the likelihood of a revival of non-public funding in response to rising capability utilization. We ought to be cautious to make sure that an unreasonably excessive actual rate of interest doesn’t thwart this a lot wanted upswing of the funding cycle. Compared to the earlier assembly, the upside dangers to inflation have abated with a moderation in crude oil costs and continued weak point in different commodity costs.

50. I’ve given cautious consideration to the in depth analyst commentary suggesting {that a} terminal repo price of 6.25 or 6.50 p.c is suitable. Much of this evaluation is from the angle of the steadiness of funds. It is true that previously (notably in 1998 and in 2013), India has very efficiently used rates of interest to defend the foreign money. However, all these episodes had been earlier than the inception of an inflation concentrating on MPC in 2016. The statutory mandate restricts the MPC to contemplate solely two elements whereas setting rates of interest – inflation and progress. It was a aware legislative option to let financial coverage be dictated by home financial issues, and go away the exterior sector to be managed utilizing different devices. This implies that the MPC can’t be guided by the impact of international financial tightening on the rate of interest differential.

51. My votes on the MPC resolutions are knowledgeable by these issues. For the primary decision on the quantum of the speed hike, I thought-about three different selections: 35, 50, and 60 foundation factors comparable to repo charges of 5.75, 5.90 and 6.00 p.c. I believe that 5.75 per cent can be properly under the terminal repo price, would depart the duty of financial tightening unfinished, and make it essential to hike charges once more within the subsequent assembly. My desire is clearly for a entrance loaded hike to the 6 p.c stage that I’ve argued for within the above paragraphs. The majority of the MPC has chosen 5.90 p.c which is barely barely under my most popular price of 6 p.c. As I’ve defined in previous statements, 10 foundation factors is just not materials and I’m pleased to go together with the bulk of the MPC on this concern. Therefore, I vote in favour of rising the coverage repo price by 50 foundation factors to five.90 p.c. However, I vote in opposition to the second decision as a result of for my part the MPC ought to now pause quite than concentrate on additional tightening.

Statement by Dr. Rajiv Ranjan

52. Central banks throughout the globe proceed their combat in opposition to inflation this yr with greater than a dozen central banks mountain climbing charges by 75 bps or much more in a single go. While international monetary markets are witnessing the instant brunt with related spillovers for rising markets together with India on account of danger-off sentiment and US greenback power, ‘historic’ international progress slowdown is the medium-time period danger that the world economy has to face.

53. India is in a a lot better place relative to many different elements of the world. Growth is resilient, and that’s additionally encapsulated in improve in progress forecasts for Q2, Q3 and This fall of 2022-23. Although exports are weak to international progress decelerate, it might be offset by some beneficial spillovers from decrease international commodity costs coupled with different elements alluded to within the following paragraphs.

54. For Q1:2022-23, National Statistical Office (NSO) estimate of actual GDP progress at 13.5 per cent was decrease than our projection of 16.2 per cent. Despite a robust decide up in non-public consumption and funding which supported combination demand in Q1, decrease progress in authorities consumption and better drag from web exports contained progress in actual GDP. High progress in actual imports – with decrease-than-anticipated deflator inflation at 13.7 per cent regardless of sharp rise in import costs – outpaced actual export progress considerably.

55. Again, progress in touch-intensive providers as mirrored by GVA progress in commerce, inns, transport, communication and providers associated to broadcasting additionally fell brief of expectations. While this sector had exceeded its pre-pandemic stage by 1.7 per cent in This fall:2021-22 in 1 / 4 marred by Omicron, it slipped under its pre-pandemic stage by 15.5 per cent in Q1:2022-23 which was a comparatively regular quarter. Assuming this sector may have simply reached its pre-pandemic stage in Q1:2022-23 (i.e., on the Q1:2019-20 ranges), actual GVA progress would have been 16.1 per cent in the course of the quarter. Notably, this sub-group accounted for about one-fifth of the GVA within the pre-pandemic interval.

56. Accordingly, the projection for H2:2022-23 has been revised upwards. It can be anticipated that the financial exercise is more likely to maintain momentum with full-fledged celebration of festivals after two years on the again of buffers of extra family financial savings, which is able to help non-public consumption. Even although family’s monetary financial savings have normalised from a peak stage of 12.0 per cent of GDP throughout 2020-21 to eight.3 per cent in 2021-22, it’s estimated that households nonetheless had an extra saving of round 7 per cent of GDP at end-March 2022 – primarily based on their web value which is larger than the extent at end-March 2020.4 As consumption gathers traction and capability utilisation surges past a threshold, this might gasoline funding – the second engine of progress. The actual GDP progress for 2023-24, primarily based on our macroeconomic mannequin, is projected at 6.5 per cent.5 India assuming G-20 presidency in 2023 is more likely to assist financial exercise with massive infrastructure and tourism associated funding.

57. Since the final bi-month-to-month, headline CPI inflation after moderating to six.7 per cent in July edged as much as 7.0 per cent in August. Even so, month-over-month change in headline CPI (or worth momentum) was regular at round 0.5 per cent throughout June-August 2022 and two-method motion in inflation was led to by base results. Food and CPI core (CPI excluding meals and gasoline) drove worth momentum in current months, with core inflation remaining sticky across the higher tolerance threshold of 6 per cent. Food inflation registered a big decide-up in August on accentuation of worth pressures in cereals together with pulses, milk, greens and spices. Various exclusion-primarily based measures of core had been in vary of 5.9 per cent to six.2 per cent in August. In reality, all trimmed imply measures of core inflation edged up in August and had been within the vary of 6.2 per cent to six.8 per cent, with weighted median registering a pointy 80 bps decide-up in August to six.5 per cent. In some methods a decide-up of worth pressures in core in August can be seen from core diffusion indices which firmed up in August. Inflation expectations additionally stay elevated.

58. There is, nevertheless, purpose for confidence on inflation slowing down throughout the tolerance band subsequent fiscal, given lagged influence of RBI price hikes and easing of provide constraints. RBI’s quarterly mannequin-primarily based projection exhibits that inflation price throughout 2023-24, on a mean, shall be 5.2 per cent.

59. In the present macroeconomic combine, whereas a price hike on this assembly is imminent, the selection between a 35 to 50 bps is an in depth name. Given the expansion-inflation dynamics, my vote is for a rise in repo price by 50 bps and proceed with the coverage stance of withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress. First, with present inflation stage and the uncertainty round it, mooring of inflation expectations is vital to restrain the broadening of worth pressures and improve credibility of the central financial institution, the advantages of which I had defined in my final minutes. Second, by displaying continued dedication to inflation goal, financial coverage seeks centered consideration on its ‘inflation mandate’. As we live in an data-wealthy world, we could get carried away by sure data-fraction and have a tendency to type expectations, impacting costs, consumption and funding. The dedicated financial coverage actions repair the eye of numerous brokers within the economy on the ‘inflation mandate’ even when the present inflation is elevated. This, in flip, will once more assist to anchor inflation expectations.6 Third, the resilient progress about which I discussed earlier than gives us the house to behave. Fourth, regardless of the current empirical proof supporting the perceived knowledge that actual impartial charges declined each globally in addition to in India7, we want to bear in mind the extent of inflation and surplus liquidity circumstances prevailing at this juncture.

60. Reflecting the will increase within the coverage repo price, the weighted common lending price (WALR) on recent rupee loans of SCBs has elevated by 82 foundation factors in the course of the interval May to August 2022. The improve in share of exterior benchmark lending price (EBLR) linked loans (46.9 per cent as at end-June 2022) coupled with shorter reset interval for such loans have considerably improved the tempo of transmission to WALR on excellent loans. On the legal responsibility aspect, move-by means of to time period deposit charges is larger, if one considers each retail in addition to bulk deposits. The extent of transmission is anticipated to enhance additional with the upward revision in rates of interest on some small financial savings devices.

61. In a situation the place progress momentum beneficial properties additional traction and inflation pressures are projected to stay elevated over the remaining half of the yr, earlier than registering a moderation by Q1:2023-24, financial coverage has to persevere with its exit from lodging to make sure that calibrated coverage price hikes dampen inflation expectations and firmly set up our dedication to cost stability. This would assist obtain the optimum combine of progress and inflation which is able to set the foundations for a excessive progress trajectory over the medium time period.

Statement by Dr. Michael Debabrata Patra

62. Central banks race in lockstep to boost coverage charges by way more than their very own historic expertise. After all, present ranges of inflation haven’t been seen in many years. Are they overshooting, or overdoing it?

63. They are balancing the prospects of a recession in opposition to the dangers of inflation remaining elevated and protracted. Given their mandates and the credibility they work onerous to earn (within the pandemic, they prioritised revival over worth stability which can’t be faulted, however it’s), they like now to err on the aspect of hawkishness of their willpower to carry inflation to targets, fearing a Nineteen Seventies redux.

64. This inflation shock defeats typical forecasting fashions. The parameters that characterise current developments are far exterior the ranges predicted by the standard fashions. No one actually is aware of what is just too far or what is way sufficient on this atmosphere. Central banks, subsequently, undertake a danger minimisation technique, making certain they eradicate inflation, whereas permitting them to appropriate course and decrease rates of interest later if mandatory.

65. Even so, at present obtainable projections of inflation recommend that the true coverage charges will stay damaging as much as shut of 2022. Hence, extra forceful tightening of financial coverage in 2023 could also be required if terminal charges should be achieved. This is being mirrored in aggressive ahead steering, which has successfully restrained the reduction rally that adopted within the wake of pricing in of massive price actions within the current previous. Currency slides have turn out to be cliff occasions. Equities and bonds alike are promoting off. Extreme danger aversion grips markets and traders.

66. Inflation administration is instantly sophisticated by the crystallisation of the unimaginable trinity. The conduct of domestically oriented financial coverage is changing into hostage to unidirectional alternate market volatility and cellular capital flows looking for protected haven. Recession dangers could also be darkening the horizon, however extra instantly, international macroeconomic and monetary stability is underneath menace. No nation is immune. Systemic central banks ought to pay heed to the likelihood that right now’s spillovers can turn out to be tomorrow’s spillbacks.

67. For web commodity importers like India, with over a 3rd of the CPI being imported, a damaging phrases of commerce shock convolutes macroeconomic administration. As present account deficits widen and capital flows flip fickle, reserve depletions turn out to be not simply sources of foreign exchange liquidity to a danger wrung market but in addition devices of stabilising expectations – the RBI stands for stability. Minimising volatility within the alternate price turns into vital from two factors of view: (a) limiting dangers to monetary stability from overseas alternate exposures and pressures on margins of firms; and (b) making certain orderly functioning of monetary markets in order that volatility doesn’t translate into monetary stability dangers. Accumulations throughout happier occasions have proved to be prudent.

68. Spillovers are international and overwhelming; nevertheless, the duty for securing stability is nationwide. Each nation is by itself.

69. In India, the moderation in inflation that had commenced in May 2022 has been interrupted by provide shocks which can prolong into September. Although these shocks seem transitory at this juncture – barring vitality costs which shall be formed by the evolving geopolitical scenario – it’s vital to stay watchful about second order results if the shocks persist or recur. What is disquieting, nevertheless, is that inflation stripped of these transitory results has turn out to be unyielding and tightly vary sure across the higher tolerance band of the inflation goal. The RBI’s ahead-wanting surveys recommend that promoting costs in manufacturing and providers could rise additional as move-by means of from enter price pressures stays incomplete. Exchange price volatility is amplifying these core worth pressures, particularly in view of key import costs being invoiced within the US greenback. Inflation expectations are rising, with indicators that they’re changing into unanchored over a one yr forward horizon. Taken along with a closing output hole, rising capability utilisation in manufacturing, surging demand for providers and the decide-up in spending because the pageant season nears, financial coverage should transfer to purple alert.

70. At this vital juncture, financial coverage has to carry out the function of nominal anchor for the economy because it charts a brand new progress trajectory. The focus ought to be on being time constant in aligning inflation with the goal. In this context, entrance-loading of financial coverage actions can preserve inflation expectations firmly anchored and steadiness demand in opposition to provide in order that core inflation pressures ease. It may also cut back the medium-time period progress sacrifice related to steering inflation again to focus on as a result of it’s being timed into the strengthening of the restoration of the home economy that’s underway and more likely to collect additional momentum because the yr progresses.

71. Accordingly, I vote for rising the coverage repo price by 50 foundation factors and for sustaining the stance of withdrawal of lodging.

Statement by Shri Shaktikanta Das

72. The world is within the eye of a brand new storm originating from aggressive financial coverage tightening and much more aggressive ahead steering from superior economy (AE) central banks. This has resulted in a tightening of international monetary circumstances, excessive volatility in monetary markets, danger aversion amongst traders and sharp appreciation of the US greenback. Such market turmoil on high of globalisation of inflation and deglobalisation of commerce has vastly damaging penalties for rising market economies (EMEs). Even in AEs, the narrative is more and more shifting from stagflation to potential recession. These developments are happening even because the world continues to be grappling with the shocks from COVID-19 and the battle in Ukraine.

73. Amidst all these, the Indian economy presents an image of resilience with macroeconomic and monetary stability. The steadiness sheet of key stakeholders like corporates and banks stay sturdy. In an interconnected world, nevertheless, the Indian economy is clearly impacted by the unsettled international atmosphere. There are pronounced penalties not just for our home inflation and progress dynamics, but in addition monetary markets.

74. On the expansion entrance, financial exercise is steadily enhancing. There are, nevertheless, combined indicators. While excessive frequency indicators are displaying continued momentum in exercise, international elements are placing strain on exterior demand. The progress projection of 7.0 per cent for 2022-23, subsequently, carries dangers that are broadly balanced. Whatever be the unfolding situation, India is anticipated to be among the many quickest rising main economies on the earth.

75. Headline inflation, alternatively, stays elevated and above the higher tolerance band of the goal. As per present projections, headline CPI is anticipated to reasonable to five.8 per cent in This fall of 2022-23 and additional to five.0 per cent in Q1 of 2023-24. The future trajectory stays clouded with uncertainties arising from persevering with geopolitical conflicts, risk of additional provide disruptions, unstable monetary market circumstances and home climate associated elements.

76. Overall, I stay optimistic in regards to the future prospects of the Indian economy, its resilience and capability to cope with the present and rising challenges. We must do no matter is important and underneath our management to restrain broadening of worth pressures, anchor inflation expectations and include second spherical results. The want of the hour is calibrated financial coverage motion, with a transparent understanding that it’s required for sustaining our medium-time period progress prospects. Accordingly, I vote for elevating the coverage repo price by 50 bps. As regards the stance, I vote for remaining centered on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress. It is vital to notice that though the coverage price has moved to pre-pandemic ranges, the general financial circumstances making an allowance for the liquidity place and the inflation stay accommodative. The web liquidity adjustment facility (LAF) continues to be in surplus for greater than three years. Liquidity within the system may additionally be seen in totality making an allowance for all transferring variables together with extra CRR and SLR holdings of banks, and income and expenditure sample of the federal government.

77. Going ahead, financial coverage wants to stay watchful and nimble, primarily based on incoming knowledge and evolving circumstances. We ought to stay vigilant on the inflation entrance whereas strengthening our macroeconomic fundamentals. The monetary and exterior sectors additionally proceed to be underneath the Reserve Bank’s shut watch. In the ultimate evaluation, there may be optimism and confidence across the India progress story and our present motion is anticipated so as to add credence to that narrative.

(Yogesh Dayal)

Chief General Manager

Press Release: 2022-2023/1043

![[Toyota Times] From Strengthening Foundations to Boosting Productivity – Toyota Focuses on Break-Even Volume [Toyota Times] From Strengthening Foundations to Boosting Productivity - Toyota Focuses on Break-Even Volume](https://businessfortnight.com/wp-content/uploads/2025/11/Toyota-Times-From-Strengthening-Foundations-to-Boosting-Productivity-Toyota-218x150.jpg)