On the premise of an evaluation of the present and evolving macroeconomic scenario, the Monetary Policy Committee (MPC) at its assembly right this moment (September 30, 2022) determined to:

- Increase the coverage repo price beneath the liquidity adjustment facility (LAF) by 50 foundation factors to five.90 per cent with rapid impact.

Consequently, the standing deposit facility (SDF) price stands adjusted to five.65 per cent and the marginal standing facility (MSF) price and the Bank Rate to six.15 per cent.

- The MPC additionally determined to stay targeted on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress.

These selections are in consonance with the target of reaching the medium-time period goal for client worth index (CPI) inflation of 4 per cent inside a band of +/- 2 per cent, whereas supporting progress.

The predominant issues underlying the choice are set out within the assertion under.

Assessment

Global Economy

2. Global financial exercise is weakening beneath the impression of the protracted battle in Ukraine and aggressive financial coverage actions and stances internationally. As monetary circumstances tighten, world monetary markets are experiencing surges of volatility, with sporadic promote-offs in fairness and bond markets, and the US greenback strengthening to a 20-12 months excessive. Emerging market economies (EMEs) are going through intensified pressures from retrenchment of portfolio flows, foreign money depreciations, reserve losses and monetary stability dangers, moreover the worldwide inflation shock. As exterior demand deteriorates, their macroeconomic outlook is turning into more and more opposed.

Domestic Economy

3. Real gross home product (GDP) grew 12 months-on-12 months (y-o-y) by 13.5 per cent in Q1:2022-23. While all constituents of home mixture demand expanded y-o-y and exceeded their pre-pandemic ranges, the drag from internet exports offered an offset. On the provision facet, gross worth added (GVA) rose by 12.7 per cent in Q1:2022-23, with all constituents recording y-o-y progress and most notably, companies.

4. Aggregate provide circumstances are bettering. With the south-west monsoon rainfall 7 per cent above the lengthy interval common (LPA) as on September 29 and its spatial distribution spreading to some deficit areas, kharif sowing has been catching up. Acreage was 1.7 per cent above the traditional sown space as on September 23 and only one.2 per cent under final 12 months’s protection. The manufacturing of kharif foodgrains as per first advance estimates (FAE) was 3.9 per cent under final 12 months’s fourth advance estimates (solely 0.4 per cent under final 12 months’s FAE). Activity in business and companies sectors stays in enlargement, particularly the latter, as mirrored in buying managers indices (PMIs) and different excessive frequency indicators. The index of industrial manufacturing progress, nevertheless, slowed to 2.4 per cent (y-o-y) in July.

5. On the demand facet, city consumption is being lifted by discretionary spending forward of the pageant season and rural demand is progressively bettering. Investment demand can also be gaining traction, as mirrored in rising imports and home manufacturing of capital items, metal consumption and cement manufacturing. Merchandise exports posted a modest enlargement in August. Non-oil non-gold imports remained buoyant.

6. CPI inflation rose to 7.0 per cent (y-o-y) in August 2022 from 6.7 per cent in July as meals inflation moved larger, pushed by costs of cereals, greens, pulses, spices and milk. Fuel inflation moderated with discount in kerosene (PDS) costs, although it remained in double digits. Core CPI (i.e., CPI excluding meals and gasoline) inflation remained sticky at heightened ranges, with upside pressures throughout varied constituent items and companies.

7. Overall system liquidity remained in surplus, with the typical day by day absorption beneath the liquidity adjustment facility (LAF) easing to ₹2.3 lakh crore throughout August-September (as much as September 28, 2022) from ₹3.8 lakh crore in June-July. Money provide (M3) expanded y-o-y by 8.9 per cent, with mixture deposits of business banks rising by 9.5 per cent and financial institution credit score by 16.2 per cent as on September 9, 2022. India’s overseas alternate reserves have been positioned at US$ 537.5 billion as on September 23, 2022.

Outlook

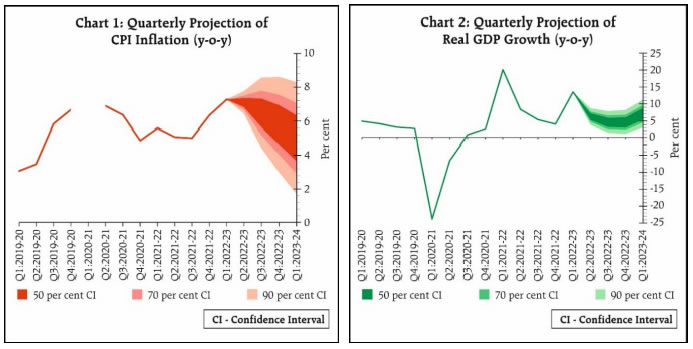

8. High and protracted uncertainty surrounding the course of geopolitical circumstances weighs closely on the inflation outlook. Commodity costs, nevertheless, have softened and recession dangers in superior economies (AEs) are rising. On the home entrance, the late restoration in sowing augurs effectively for kharif output. The prospects for the rabi crop are buffered by comfy reservoir ranges. The threat of crop injury from extreme/unseasonal rains, nevertheless, stays. These components have implications for the meals worth outlook. Elevated imported inflation pressures stay an upside threat for the longer term trajectory of inflation, amplified by the persevering with appreciation of the US greenback. The outlook for crude oil costs is very unsure and tethered to geopolitical developments, with attendant issues regarding each provide and demand. The Reserve Bank’s enterprise surveys level to some easing of enter price and output worth pressures throughout manufacturing, companies and infrastructure corporations; nevertheless, the go-by of enter prices to costs stays incomplete. Taking under consideration these components and a mean crude oil worth (Indian basket) of US$ 100 per barrel, inflation is projected at 6.7 per cent in 2022-23, with Q2 at 7.1 per cent; Q3 at 6.5 per cent; and This fall at 5.8 per cent, and dangers are evenly balanced. CPI inflation for Q1:2023-24 is projected at 5.0 per cent (Chart 1).

9. On progress, the bettering outlook for agriculture and allied actions and rebound in companies are boosting the prospects for mixture provide. The Government’s continued thrust on capex, enchancment in capability utilisation in manufacturing and choose-up in non-meals credit score ought to maintain the enlargement in industrial exercise that stalled in July. The outlook for mixture demand is optimistic, with rural demand catching up and concrete demand anticipated to strengthen additional with the everyday upturn within the second half of the 12 months. According to the RBI’s surveys, client outlook stays secure and corporations in manufacturing, companies and infrastructure sectors are optimistic about demand circumstances and gross sales prospects. On the opposite hand, headwinds from geopolitical tensions, tightening world monetary circumstances and the slowing exterior demand pose draw back dangers to internet exports and therefore to India’s GDP outlook. Taking all these components into consideration, actual GDP progress for 2022-23 is projected at 7.0 per cent with Q2 at 6.3 per cent; Q3 at 4.6 per cent; and This fall at 4.6 per cent, and dangers broadly balanced. For Q1:2023-24, it’s projected at 7.2 per cent (Chart 2).

10. In the MPC’s view, inflation is prone to be above the higher tolerance degree of 6 per cent by the primary three quarters of 2022-23, with core inflation remaining excessive. The outlook is fraught with appreciable uncertainty, given the risky geopolitical scenario, world monetary market volatility and provide disruptions. Meanwhile, home financial exercise is holding up effectively and is anticipated to be buoyant in H2:2022-23, supported by festive season demand amidst client and business optimism. The MPC is of the view that additional calibrated financial coverage motion is warranted to maintain inflation expectations anchored, restrain the broadening of worth pressures and pre-empt second spherical results. The MPC feels that this motion will help medium-time period progress prospects. Accordingly, the MPC determined to extend the coverage repo price by 50 foundation factors to five.90 per cent. The MPC additionally determined to stay targeted on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress.

11. Dr. Shashanka Bhide, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to extend the coverage repo price by 50 foundation factors. Dr. Ashima Goyal voted to extend the repo price by 35 foundation factors.

12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to stay targeted on withdrawal of lodging to make sure that inflation stays throughout the goal going ahead, whereas supporting progress. Prof. Jayanth R. Varma voted towards this half of the decision.

13. The minutes of the MPC’s assembly will probably be printed on October 14, 2022.

14. The subsequent assembly of the MPC is scheduled throughout December 5-7, 2022.

(Yogesh Dayal)

Chief General Manager

Press Release: 2022-2023/967