Ministry of Finance

Transforming India’s Digital Payment Landscape

Posted On: 03 OCT 2022 2:52PM

Recent years have seen a technological revolution in governance in India. Government companies have been slowly and steadily introduced on board and in the present day, last-mile supply occurs with the clicking of a mouse in seconds. Digital Payments transactions have been persistently rising over the previous couple of years, as part of the Government of India’s technique to digitise the monetary sector and economy. Further, concerted efforts have been made to advertise monetary inclusion as one of many necessary nationwide aims of the nation.

The key enabler on the centre of India’s reworked digital cost panorama is the JAM Trinity – Jan Dhan, Aadhaar and Mobile. Pradhan Mantri Jan-Dhan Yojana (PMJDY) is among the greatest monetary inclusion initiatives on the planet, launched in August 2014, to supply common banking companies for each unbanked family. Aadhaar, the Unique Identification Authority of India’s flagship product, is a straightforward however efficient technique to confirm people and beneficiaries based mostly on their biometric info. Jan Dhan accounts, Aadhaar and Mobile connections, taken collectively, have helped lay the foundations of a Digital India the place an enormous array of Government companies are made out there on to the citizen with enhanced ease of entry with out the presence of any middleman (middle-men).

Digital Payment Ecosystem in India

One of the main aims of Digital India is to attain “Faceless, Paperless, Cashless” standing. The promotion of digital funds has been accorded the very best precedence by the Government of India to carry every phase of our nation underneath the formal fold of digital cost companies. The imaginative and prescient is to supply the ability of seamless digital cost to all residents of India in a handy, straightforward, inexpensive, fast and secured method.

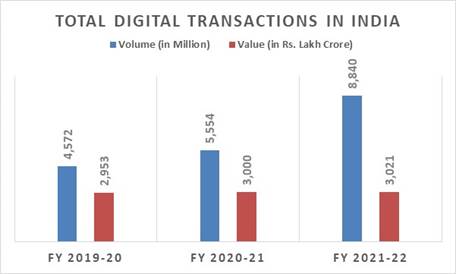

During the final three years, digital cost transactions have registered unprecedented progress in India. Easy and handy modes of digital cost, resembling Bharat Interface for Money-Unified Payments Interface (BHIM-UPI); Immediate Payment Service (IMPS); pre-paid cost devices (PPIs) and National Electronic Toll Collection (NETC) system have registered substantial progress and have reworked digital cost ecosystem by rising Person-to-Person (P2P) in addition to Person-to-Merchant (P2M) funds. At the identical time, pre-existing cost modes resembling debit playing cards, bank cards, National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) have additionally grown at a quick tempo. BHIM-UPI has emerged as the popular cost mode of customers. The Government of India additionally launched the digital cost resolution e-RUPI, a cashless and contactless instrument for digital cost which is anticipated to play an enormous position in making Direct Benefit Transfer (DBT) simpler in digital transactions within the nation. All these services collectively have created a sturdy ecosystem for a digital finance economy.

UPI: Revolutionizing Digital Payments

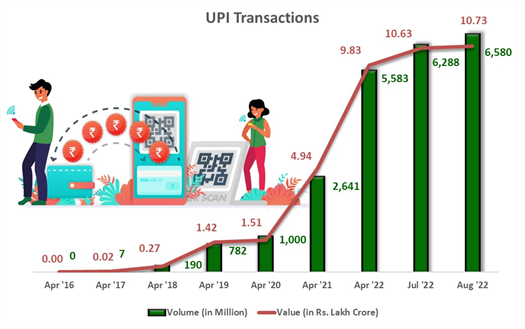

UPI has been termed a revolutionary product within the cost ecosystem. Launched in 2016, it has emerged as one of the vital standard instruments within the nation for finishing up digital transactions. UPI is an immediate cost system developed by the National Payments Corporation of India (NPCI). It powers a number of financial institution accounts right into a single cell software, merging a number of banking options, seamless fund routing and service provider funds into one hood. To additional strengthen and popularise the interface, Prime Minister Narendra Modi launched the BHIM-UPI App in the course of the inauguration of the ‘DigiDhan Mela’ on December 31, 2016.

UPI has gone a good distance in making digital funds a behavior, and in firmly putting India on the observe towards a cashless economy. In the month of August 2022 alone, 346 banks had been dwell on the UPI interface, with 6.58 billion monetary transactions being carried out for a complete worth of practically Rs. 10.73 lakh crores.

UPI presently constitutes properly over 40% of all digital transactions happening in India. It has given a lift to small companies and road distributors because it allows quick and safe bank-to-bank transactions even for significantly small quantities. It additionally facilitates fast cash transfers for migrant staff. The expertise is handy to make use of because it requires minimal bodily intervention, making it attainable to switch cash just by scanning a QR code. UPI has additionally been a saviour in the course of the Covid-19 pandemic, with its adoption increasing quickly attributable to its capability to permit straightforward, contactless transactions.

Today, there isn’t a doubt that the digital cost panorama in India has been reworked. Complementing the efforts of the Government, the folks of India have additionally displayed a fantastic affinity for embracing new applied sciences. While a few of the developed international locations are going through issues attributable to insufficient digital infrastructure for transferring cash to the accounts of their residents, India has emerged as a pacesetter within the creation of digital belongings, which may serve for instance to many different nations. Further, the Government of India is leaving no stone unturned to make India a worldwide chief within the area of digital cost programs and assist it attain the standing of one of the vital environment friendly funds markets on the planet. Going ahead, the rising Fin-Techs will play a key position within the additional progress of digital transactions by enabling clear, safe, swift and cost-effective mechanisms benefiting your entire digital funds ecosystem.

***

AG/HP/RC/PPD/SS

(Features ID: 151163)

0