Aim is to herald extra investor curiosity and capital wanted for trade’s projected progress of a $500 billion gross author premium 2027

Representational picture.

File image

|

Calcutta

|

Published 15.10.22, 02:24 AM

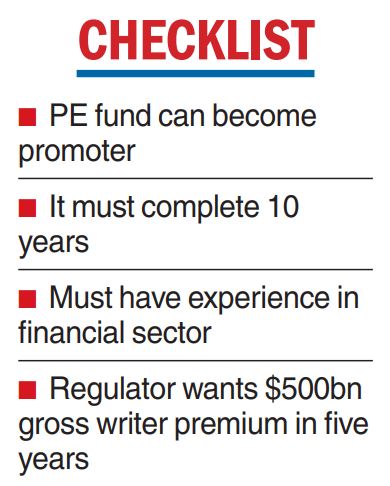

The insurance trade regulator has proposed modifications that would permit personal equity funds to have a wider position together with as promoters in insurance corporations.

The draft IRDAI (Registration of Indian Insurance Companies) Regulations, 2022 has offered the standards of funding by personal equity gamers.

The intention is to herald extra investor curiosity and capital wanted for the trade’s projected progress of a $500 billion gross author premium 2027.

According to the IRDAI draft proposal, a personal equity (PE) fund may spend money on any insurer within the capability of “promoter” on the situation that it ought to full 10 years of operation.

The funds raised by the PE together with its group entity(ies) is $500 million or extra (or its equal in rupees).

The investible funds obtainable with the PE isn’t lower than $100 million.

The fund should have investments within the monetary sector in India or different jurisdiction.

A brand new introduction within the proposed modifications is the “fit and proper” standards to be labeled as a promoter or an investor in an Indian insurance firm.

The regulator will take a look at the monetary energy, capacity to infuse capital to satisfy solvency and regulatory necessities, compliance with the present legal guidelines together with Fema and taxation legal guidelines together with the business report and expertise of the applicant.

The regulator will even consider areas of due diligence corresponding to insider buying and selling, fraudulent or unfair commerce practices or market manipulation by the fund or any of its promoters/group entities, governance and capital construction and sources of funds.

The regulator has additionally launched lock-in intervals whereby the equity shares of the promoter or the investor might be locked in for sure tenure from the time of funding.

For occasion, if the funding is made by the promoter on the time of grant of certificates of registration of the insurance firm, the lock in interval is proposed at 5 years.

If the funding is made after 10 years of grant of certificates of registration, the lock in for the promoter is 2 years and for the investor three years.

The regulator has additionally streamlined the method of registration of insurance corporations in a bid to enhance the convenience of business, a standards which is keenly checked out by abroad buyers.

Bima Sugam

IRDAI has additionally deliberate a digital platform known as “Bima Sugam” for promoting, servicing and settling claims.

In essence, it’ll act as an Amazon-like platform the place all life and basic insurance insurance policies could be listed.