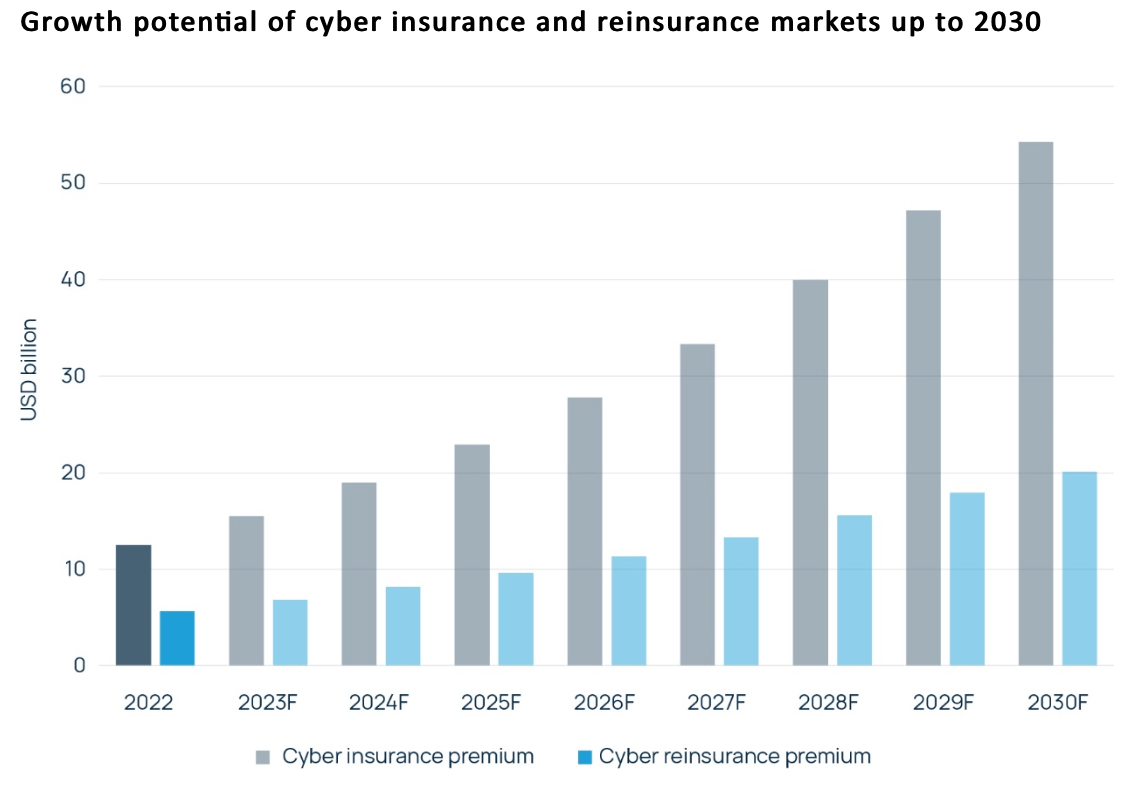

International insurance broker Howden has suggested that the size of the cyber insurance market could reach $50 billion by 2030, though the realisation of this potential is tied to three key factors: distribution, tail-risk management and attracting capital.

“If these challenges can be navigated successfully, the cyber market is on the cusp of potentially transformational growth,” the insurance broker explained in its third annual cyber insurance report.

According to the firm, following a major market correction off the back of surging ransomware claims in 2020 and 2021, conditions started to stabilise last year as activity relented and more robust risk controls deterred or mitigated attacks.

However, Howden notes that “cyber rarely stands still”, and developments in 2023 point to a “nuanced marketplace”, with optimism around more favourable supply dynamics for insurance buyers tempered by resurgent ransomware activity, ongoing concerns about potential systemic losses and capital availability.

“The first half of 2023 saw a significant rise in ransomware attacks, but disclosures from a number of carriers in 1Q23 suggest this has not (yet) been accompanied by a corresponding rise in claims,” Howden’s report noted.

The firm continued, “This points to the efficacy of risk controls in making companies more resilient and supporting a more stable cyber insurance market. Conditions are now relenting, and buyers that have the correct risk controls in place are being rewarded with more favourable pricing and terms.”

Howden has said that this puts the market on a “sound footing for growth”, though the report also highlighted that more work needs to be done if it is to meet the growing demands of clients worldwide.

The insurance broker suggested, “By overcoming potential limitations around systemic risk, penetration and capital, the cyber insurance market has an unparalleled opportunity to grow.”

Discussing the pricing increases in recent years, Dan Leahy, Associate Director, Howden, said, “Having navigated the early phases of development that often come with new, fast-growing lines of business, the cost of cyber insurance is now more commensurate with loss costs following the recent correction.

“Whilst the first half of 2023 has seen pricing decline, the sustainability of this trend remains uncertain given the pervasive threat environment.

“Rates nevertheless cannot be relied upon to drive market expansion to the extent that they have recently, requiring ambitious plans for exposure growth. Penetrating new territories and company demographics is therefore pivotal to realising the full potential of cyber insurance.”