Over the previous 10 years, the variety of licensed captive insurance entities registered in The Bahamas has grown – at first very quickly and, in the final 5 years, steadily. As a outcome, development has occurred in total web premium quantity together with the growth in the variety of mother or father firm areas all through the US and Europe, says Carl Culmer, Manager for Policies and Practices on the Insurance Commission of The Bahamas.

The development in The Bahamas’ captive market is essentially attributed to small-to-medium sized entities (SMEs) looking for to arrange their very own segregated accounts. This choice has confirmed to be cost-effective for these SMEs, particularly since they will and do outsource administrative and operational oversight to regionally registered insurance managers, monetary and company service suppliers and different monetary service professionals resembling attorneys and accountants.

SMEs throughout various industries are all in the Bahamian captive market. Their goal is to minimise losses that they may incur in the course of the course of their operations. Such an entity is perhaps both a stand-alone firm, i.e. a single-parent firm, or a registered segregated account in an already licensed segregated account (captive insurance) firm. A stand-alone entity is included, whereas a segregated account (or cell captive) types a part of a registered Segregated Accounts Company. A typical firm considers the dimensions, nature and complexity of its operations earlier than making use of for the suitable class of licence that most closely fits its technique and business pursuits.

Presently, all captives are licensed as ‘exterior insurers’ in accordance with the External Insurance Act 2009. The Bahamas continues to register captives that insure threat related to varied industries resembling medical and healthcare administration, retail and wholesale distribution, agriculture, development and actual property. The traces of business prolonged as protection inside these constructions embody employees’ compensation advantages, cyber-risk, administrators’ and officers’ (D+O) insurance and extra legal responsibility.

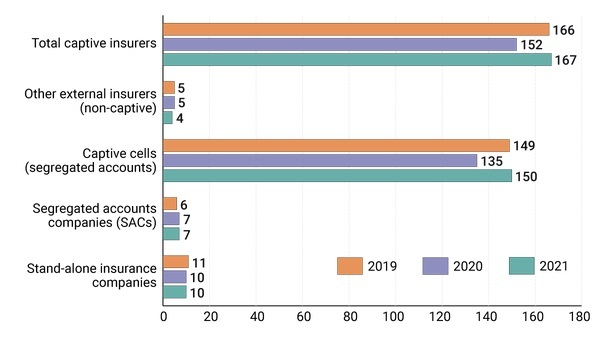

After a spate of development earlier in the final decade, the combination variety of segregated accounts continues to display gradual development over the previous three years. The chart beneath outlines the variety of exterior insurers recognized as captives for the interval 2019-2021.

The current laws has actually helped the insurance sector to develop to a passable diploma and the fee is set to maintain the relevant legislation aggressive with the legal guidelines of different jurisdictions. It additionally stays intent on holding its regulatory and supervisory regime efficient and in line with the excessive requirements of the International Association of Insurance Supervisors and the suggestions submitted by the Financial Action Task Force.

In 2021, as a part of its strategic plan to amalgamate laws, the fee started a assessment of the jurisdiction’s two principal insurance legal guidelines – the Insurance Act, 2005 and the External Insurance Act, 2009.

The objective of the assessment, which continues to be in progress, is to streamline regulatory and supervisory necessities and to boost laws to assist insurance constructions.

The fee has collaborated with business associations, professionals and most of the people as a part of its consultative effort. Individuals and firms have been eager to make use of these discussions to search out out extra in regards to the captive market with a view to establishing captives of their very own to assist their medium-to-long-term risk-management methods.

Despite the lingering results of the worldwide pandemic of 2020, worldwide firms are nonetheless expressing curiosity in regards to the institution of captives in The Bahamas. The insurance business continues to display its monetary resilience to financial shocks.

The efficient use of captives may function an extra absorber for firms which have suffered from such international shocks.

The Bahamas’ participation in the captive insurance business dates again to the Sixties. Given the islands’ wealthy historical past in this area of interest business, the federal government has taken steps in current years to make sure this business actively contributes to the general development of the monetary providers sector. Local insurance managers and different monetary intermediaries are nonetheless discovering methods to advertise each their very own providers and the jurisdiction as a complete in the captive market.

The Bahamas Financial Services Board (BFSB) has helped them accomplish that, highlighting the jurisdiction as a reliable and aggressive worldwide monetary centre that promotes synergies between the industries of the monetary providers sector. The fee, together with the BFSB and the nation’s captive insurance professionals, participates actively in the captive insurance business’s occasions and coaching seminars. This ensures that every one stakeholders stay well-acquainted with the business’s trending matters, challenges and alternatives.

The fee’s partnership with the BFSB has prolonged the promotional outreach of the jurisdiction as a captive domicile and has supplied a discussion board in which significant discussions happen.

The BFSB, together with the fee, will proceed to work with the federal government of The Bahamas to focus on the captive insurance and reinsurance business as an space of financial curiosity. Companies that wish to base their insurance business in The Bahamas ought to be aware the important thing regulatory necessities for approval.

The exterior (captive) insurer utility course of consists of the next:

1. A scheduled pre-application assembly to debate the proposed business plan.

2. Submission of a accomplished utility that features, however isn’t restricted to, the next:

a) An in depth business plan;

b) An actuarial assessment or feasibility research;

c) Projected monetary statements for 3 years (inclusive of steadiness sheet, earnings assertion and solvency calculations);

d) Sample insurance policies to be marketed and offered by the applicant;

e) Details of the reinsurance programme (the place relevant); and

f) Due diligence’ paperwork for proposed shareholders, administrators and senior officers.

3. Review of the appliance and consideration for approval by the fee’s Board of Commissioners.

This is mostly a two-stage course of. Subject to passable assessment of the appliance, the fee initially grants the applicant approval in precept with circumstances. Applicants are then given 30-60 days to fulfill these circumstances of approval.

Once the circumstances of approval are met, the ICB points a certificates of licence to the applicant.

Every captive insurance firm in The Bahamas should, amongst different issues, fulfill the next necessities.

• A minimal of two administrators.

• The appointment of a resident consultant in the Bahamas at whose workplace books and information should be maintained.

• A minimal of US$100,000 in share capital (extra regulatory capital could also be required relying on the character, measurement, and scope of the proposed entity).

• Application payment of US$100 (stand-alone) and US$250 (per segregated account).

• Annual (stand-alone) renewal payment of US$2,500.

Information about captive insurance in The Bahamas will be discovered on our web site at www.icb.gov.bs. Interested individuals can also contact [email protected]

Carl Culmer is Manager for Policies and Practices on the Insurance Commission of the Bahamas

He will be reached on +1 242 397 4183/376 7242 or at [email protected]

The full Bahamas Special Report 2022 ezine with a complete listing of options and movies is obtainable to view/learn right here.