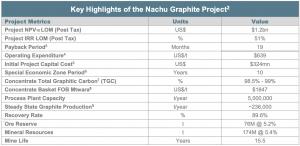

Nachu Graphite BFS Key Highlights

Nachu Project Tanzania 3D Concept Render 1

Nachu Project Tanzania 3D Concept Render 2

Strong technical & monetary viability. Impactful sustainability. Optimised course of plant design: higher-grade product and defend flake measurement throughout processing.

Magnis Energy Technologies (OTCQX:MNSEF)

SYDNEY, NSW, AUSTRALIA, September 28, 2022 /EINPresswire.com/ — Magnis Energy Technologies Ltd (“Magnis”, or the “Company”) (ASX: MNS; OTCQX: MNSEF; FSE: U1P) is happy to announce that it has accomplished an replace to the 2016 Bankable Feasibility Study (BFS) for its Nachu graphite mission in Tanzania (the Nachu Project or the Project) and confirms that the Project continues to display sturdy monetary and technical viability. Commenting on the completion of the BFS replace, Magnis Energy Technologies, CEO, David Taylor said:

“The replace to the BFS demonstrates that the Nachu Graphite Project represents among the best graphite manufacturing alternatives in at this time’s market. The mission will produce a top quality, sustainable product that requires minimal purification, putting Magnis in a powerful aggressive place relative to others out there. Our excessive purity graphite focus will present lithium-ion battery producers and different industrial prospects with a sexy and aggressive different to present sources within the world graphite market.

The replace to the BFS has targeted on enhancing the plant course of design to make sure it maintains our product high quality benefit, using a extra sustainable and environment friendly energy provide, and reviewing the general capital and working prices of the mission. As anticipated, and in line with the mining

trade as a complete, now we have seen will increase in capital prices from 2016, though alternatives stay to enhance the present capital value estimates as a part of the subsequent stage of optimization and detailed engineering. Pleasingly, working prices have remained comparatively steady and place Magnis effectively by way of anticipated margins.

With present offtakes in place, and discussions with different main offtakers in key sectors effectively superior, we’re assured that the mission can be strongly supported by mission funders. Initial discussions with funders have commenced, and now we have acquired optimistic responses in relation to the general bankability and attractiveness of the mission. A rigorous monetary threat administration technique can be put in place to make sure that Magnis can defend and improve mission returns as financial circumstances undoubtedly change over the course of the mission life.

I wish to thank the Magnis workforce and all our companions concerned within the replace to the BFS for the intensive work that has been accomplished. Given the monetary outcomes demonstrated by the replace, and the continued power within the lithium-ion battery market pushed by the expansion of the electrical car and power storage sectors, we’re wanting ahead to advancing the mission as rapidly as potential. Our subsequent milestones are making a Final Investment Decision (FID) and reaching monetary shut, which we’re concentrating on to realize by finish Q2 2023. This is an thrilling interval of progress for the corporate, and we look ahead to working with all stakeholders to produce prime quality supplies that may generate optimistic financial, social, and environmental outcomes.”

Group Communications Manager

Magnis Energy Technologies

+61 426 042 590

e-mail us right here

![]()