5G in Aerospace & Defense Market – Exclusive Report by 360iResearch

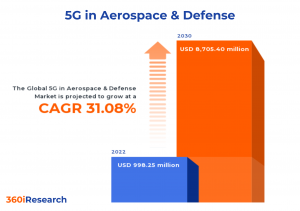

The Global 5G in Aerospace & Defense Market to grow from USD 998.25 million in 2022 to USD 8,705.40 million by 2030, at a CAGR of 31.08%.

PUNE, MAHARASHTRA, INDIA, November 7, 2023 /EINPresswire.com/ — The “5G in Aerospace & Defense Market by Communication Infrastructure (Macro Cell, Small Cell), Operational Frequency (High, Low, Medium), Core Network Technology, End Use – Global Forecast 2023-2030” report has been added to 360iResearch.com’s offering.

The Global 5G in Aerospace & Defense Market to grow from USD 998.25 million in 2022 to USD 8,705.40 million by 2030, at a CAGR of 31.08%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/5g-in-aerospace-defense?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The 5G in aerospace & defense market encompasses implementing fifth-generation wireless communication technology within the aerospace and defense sectors. This market focuses on enhancing mission-critical services through ultra-reliable, low-latency communication, high-speed data transfer, and seamless connectivity across devices, sensors, and systems. Key applications include military communications, unmanned aerial vehicles (UAVs), air traffic control systems, aircraft operations support, satellite communication networks, and defense infrastructure. The increasing need for secure real-time communication across various domains such as land, air, sea, or space in dynamic digital battlefields and advancements in satellite communication technologies offering global connectivity with reduced latency through terrestrial networks supports the 5G network. On the other hand, high initial investment costs related to infrastructure deployment, security concerns surrounding 5G network implementation exposing vulnerabilities to cyber-attacks targeting critical defense information, and lack of globally harmonized spectrum allocation for 5G communication pose obstacles to market growth. They may lead to interoperability issues between systems from different regions. However, advances in 5G technologies for the military & defense sector and the deployment of autonomous and connected aircraft are expected to increase market growth in the coming years.

Core Network Technology: Rising use of mobile edge computing for decentralized data processing in mission-critical applications

Fog computing is a decentralized computing model that extends cloud resources to the network’s edge, enabling real-time data analysis and processing capabilities. The need for fog computing arises due to the immense amount of data generated by aerospace & defense applications, which require low-latency processing and rapid decision-making capabilities. Mobile edge computing allows on-site data processing near the generation source rather than relying on remote servers in centralized data centers. This capability significantly reduces latency and accelerates response times in mission-critical applications within aerospace & defense settings. Network functions virtualization refers to the abstraction of critical network functions from proprietary hardware devices into virtualized software instances running on commercial off-the-shelf servers. It enables greater agility, scalability, ease of management, and cost savings for aerospace & defense networks by replacing dedicated hardware devices with agile software-based solutions deployed on a common infrastructure platform. Software-defined networking is an approach that decouples the control plane from the data plane, enabling centralized management and programmability of network resources. It offers improved flexibility, simplicity, and increased security for aerospace & defense networks by automating tasks such as traffic engineering, access control policies, and performance monitoring. Fog computing and mobile edge computing offer decentralized data processing capabilities with reduced latency for mission-critical applications in aerospace & defense settings. However, mobile edge computing focuses more on mobile network integration, facilitating seamless connectivity between manned aircraft and UAVs. Network functions virtualization and software-defined networking enable the virtualization of critical network functions, providing higher agility, scalability, and ease of management at lower costs.

Communication Infrastructure: Growing adoption of macro cell for surveillance and reconnaissance

A macro cell in the communication infrastructure segment of aerospace & defense refers to traditional large-scale cell towers designed to provide wide network coverage over vast distances. These cell towers can serve several users simultaneously, making them ideal for use in large cities, rural areas, and military installations where broad geographic coverage is essential. Macro cells are indispensable for mission-critical communications within defense operations, offering extensive range and capacity required for various missions such as surveillance and reconnaissance. In the 5G era, improvements in macro cells include greater bandwidth capacity and lower latencies, allowing more effective communication between airborne assets such as unmanned aerial vehicles (UAVs), fighter jets, missiles, and ground-based command centers. Small cells refer to compact cellular base stations extending the coverage area of telecommunications networks with fewer users per node than macro cells. They are critical in providing high-capacity communication links within confined spaces, including urban areas or dense indoor environments such as military bases or aircraft carriers. The need-based preference for small cells arises from their ability to deliver increased network capacity while ensuring low latency essential for real-time communication applications in aerospace & defense, such as aircraft maintenance, troop deployment coordination, and command and control of UAVs. Small cells are an integral part of 5G network deployments due to their capacity to support millimeter wave (mmWave) frequencies that offer ultra-high-speed data transfer rates. These capabilities make them suitable for time-sensitive defense communications and secure transmission of sensitive information. The choice between macro cells and small cells depends on specific requirements within the aerospace & defense sector. Macro cells provide wide area coverage with large user capacities, making them appropriate for rural areas or military installations needing extensive connectivity range. On the other hand, small cells offer higher network capacity in confined spaces while ensuring low latency, which is crucial for real-time communication applications.

End Use: Growing adoption in military operations for faster communication

The need for seamless communication and real-time data exchange in aircraft has increased with the growing complexity of modern aviation systems. 5G technology offers enhanced connectivity, low latency, and high-speed data transmission, catering to the demand for advanced avionics, inflight entertainment, and predictive maintenance. Airports utilize 5G technology to streamline baggage handling, security checks, and passenger boarding processes. The high-speed connectivity can also enable remote management of air traffic control towers and facilitate automated vehicle operations on airport grounds. Homeland security agencies require robust communication networks for effective threat detection, emergency response coordination, and border surveillance. The adoption of 5G technology can help improve data collection from various sensors and devices while ensuring secure real-time communication between different units. 5G technology revolutionizes military operations by enabling faster communication, advanced data analytics, and improved situational awareness in mission-critical applications. This technology can facilitate autonomous vehicles, drone swarms, and network-centric warfare capabilities.

Operational Frequency: Growing demand for medium-frequency band aerospace and defense industries

High-frequency (HF) bands range over 20GHz, offering faster data transfer rates due to the shorter wavelengths. These frequencies are essential for advanced applications such as unmanned aerial vehicles (UAVs), high-speed satellite communication, and precision-guided munitions. Low-frequency (LF) bands cover the spectrum below 1GHz and are characterized by longer wavelengths that can penetrate through obstacles such as buildings and natural terrain. As a result, they are ideal for applications requiring long-range communication, such as early warning systems, remote sensing platforms (satellites), and ground-based radars. Medium-frequency (MF) bands range between 1GHz and 5GHz and balance high data transfer rates and extended communication range. These frequencies suit applications such as tactical communication networks, navigation systems, and electronic warfare solutions in urban and suburban areas. The choice between high-, low-, and medium-frequency bands is primarily driven by specific application requirements within the aerospace & defense industries. High frequencies offer faster data transmission rates for advanced systems such as UAVs but are limited by range constraints. Low frequencies provide long-range communication capabilities but at slower data rates compared to high-frequency bands. Medium frequencies balance speed and range for versatile applications such as tactical communications and electronic warfare solutions. Manufacturers must consider these trade-offs carefully when selecting appropriate frequency bands for their products and services as the adoption of 5G continues to shape these industries’ future developments.

Regional Insights:

In the Americas, particularly in North America, the United States has been at the forefront of 5G development. The U.S. Department of Defense has invested heavily in research initiatives exploring potential 5G military use cases, such as enhanced communication systems for soldiers on battlefields, advanced drone swarms for surveillance purposes, and augmented reality training programs. Compared to other regions globally, South America’s growth in this market may be slower due to limited infrastructure investments or economic constraints. However, countries such as Brazil and Mexico are progressively upgrading their military technologies, which could catalyze future opportunities for 5G adoption in aerospace & defense industries. The Asia-Pacific (APAC) is expected to witness rapid expansion of the 5G in aerospace & defense market due to increasing deployment of 5G coupled with rising military modernization efforts among key countries. China, South Korea, and Japan are aggressively investing in enhancing its military capabilities via autonomous vehicles and drones using 5G capabilities. Additionally, India is undertaking several military modernization programs and collaborations with global partners to enhance its technological prowess in defense, opening up opportunities for 5G integration. In Europe, the Middle East, and Africa (EMEA), the growth of 5G in aerospace & defense market is fueled by increasing commitments to upgrading military technologies across NATO member countries. The European Union countries are working collaboratively on joint research projects encompassing 5G technology in border security and critical infrastructure protection. In the Middle East, countries such as Israel, Saudi Arabia, and the United Arab Emirates are investing in modernizing their defense sectors, which could lead to an increased demand for advanced communication systems powered by 5G.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the 5G in Aerospace & Defense Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the 5G in Aerospace & Defense Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the 5G in Aerospace & Defense Market, highlighting leading vendors and their innovative profiles. These include Airspan Networks Holdings Inc., AKKA Technologies SE, Analog Devices, Inc., AT&T Inc., AttoCore Ltd., Cisco Systems, Inc., Cubic Corporation, Deutsche Telekom AG, Fujitsu Limited, General Electric Company, Honeywell International Inc., Huawei Technologies Co., Ltd., Intelsat S.A., L3Harris Technologies, Inc., Lockheed Martin Corporation, Nokia Corporation, QUALCOMM Incorporated, Raytheon Technologies Corporation, Rohde & Schwarz GmbH & Co. KG, Samsung Electronics Co., Ltd., Tech Mahindra Limited, Telefonaktiebolaget LM Ericsson, Telefónica S.A., Thales Group, Verizon Communications Inc., Viasat, Inc., and Wind River Systems, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/5g-in-aerospace-defense?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the 5G in Aerospace & Defense Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Communication Infrastructure, market is studied across Macro Cell and Small Cell. The Macro Cell commanded largest market share of 57.35% in 2022, followed by Small Cell.

Based on Operational Frequency, market is studied across High, Low, and Medium. The Medium commanded largest market share of 39.12% in 2022, followed by High.

Based on Core Network Technology, market is studied across Fog Computing, Mobile Edge Computing, Network Functions Virtualization, and Software-Defined Networking. The Mobile Edge Computing commanded largest market share of 32.65% in 2022, followed by Fog Computing.

Based on End Use, market is studied across Aircraft, Airport, Homeland Security, and Military. The Military commanded largest market share of 31.56% in 2022, followed by Airport.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 40.53% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. 5G in Aerospace & Defense Market, by Communication Infrastructure

7. 5G in Aerospace & Defense Market, by Operational Frequency

8. 5G in Aerospace & Defense Market, by Core Network Technology

9. 5G in Aerospace & Defense Market, by End Use

10. Americas 5G in Aerospace & Defense Market

11. Asia-Pacific 5G in Aerospace & Defense Market

12. Europe, Middle East & Africa 5G in Aerospace & Defense Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the 5G in Aerospace & Defense Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the 5G in Aerospace & Defense Market?

3. What is the competitive strategic window for opportunities in the 5G in Aerospace & Defense Market?

4. What are the technology trends and regulatory frameworks in the 5G in Aerospace & Defense Market?

5. What is the market share of the leading vendors in the 5G in Aerospace & Defense Market?

6. What modes and strategic moves are considered suitable for entering the 5G in Aerospace & Defense Market?

Read More @ https://www.360iresearch.com/library/intelligence/5g-in-aerospace-defense?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

[email protected]

![]()